Indexing either via Exchange Traded Funds (ETF) or via Robo Advisors is a trend in focus these days, for good reason – the traditional alternative (i.e. mutual funds) has not delivered satisfactory results for the fees charged. So picking indexing ETFs over mutual funds might seem like an easy (and the right) choice for you.

But what about indexing vs. active management? If mutual funds didn’t represent the best active management had to offer, then what does? I think a portion of the answer lies in what I call Concentrated Portfolio (CP).

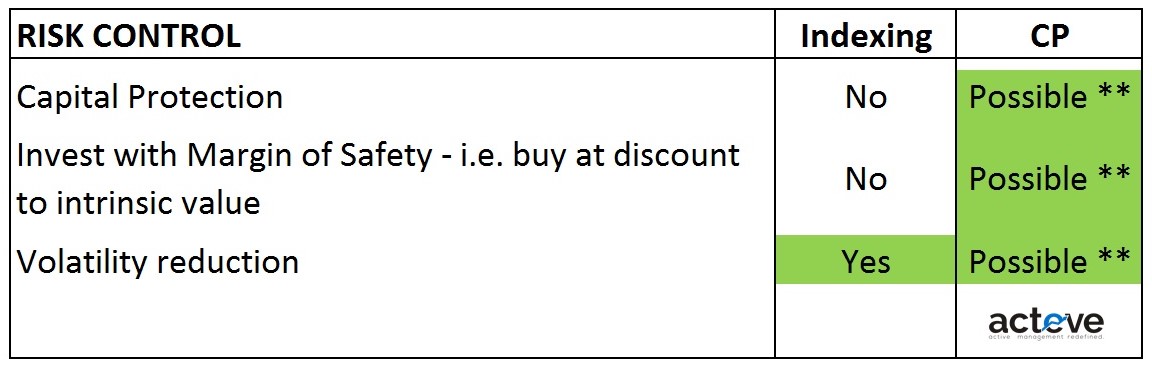

The tables below provide a framework to compare two diametrically opposite styles of investing – indexing vs. concentrated portfolio, starting with Risk Controls.

** acteve Model Portfolio – Concentrated Value Portfolio

Indexing comprises of investing in a pre-defined market index, e.g. S&P 500 index. By definition, every dollar added to the account is invested uniformly across the components of the index – i.e. there is no allocation to cash. For the purpose of this discussion I assume that we are working with a single index (e.g. S&P 500 index), and that investments are being made automatically on a pre-determined basis (e.g. fixed amount each month) into a fund tracking the chosen index.

Concentrated Portfolio (CP) involves investing in a limited number (say ~20) of carefully chosen securities, including cash, which is given a deliberate and purposeful allocation. There are of course a lot of ways to run a CP – Value investing is one of them. My (aMP) focus is on actively managed concentrated value portfolio.

For a significant portion of investors an optimal investment approach might be a combination of indexing and concentrated portfolio. The exact mix of the two for you will depend on your risk tolerance, level of assets, proximity to retirement, as well as appetite for going against the consensus view, among other things.

Real risk tolerance will depend in part on forming a good understanding of what risk means. For example, how would you feel if the value of your portfolio declined by 25% commensurate with a broader decline in the market? Would you “ignore” it and decide to plow more assets into the market, or do the exact opposite? Assuming that over the “long run” markets “always” appreciate might be mildly comforting in the moment, but reality is you never know if that will continue to hold true, or specifically how long “long term” will really be.

Appetite for going against the consensus view might be a more complex function of personality, understanding of financial markets, and finding a trustworthy investment advisor. It tends to be a heavily psychological exercise, one that you want to undertake with more preparation rather than less. Buying when the market is down 25% is one example of a contrarian approach – it may be easy to talk about during good times, but is assuredly more difficult to execute in reality.

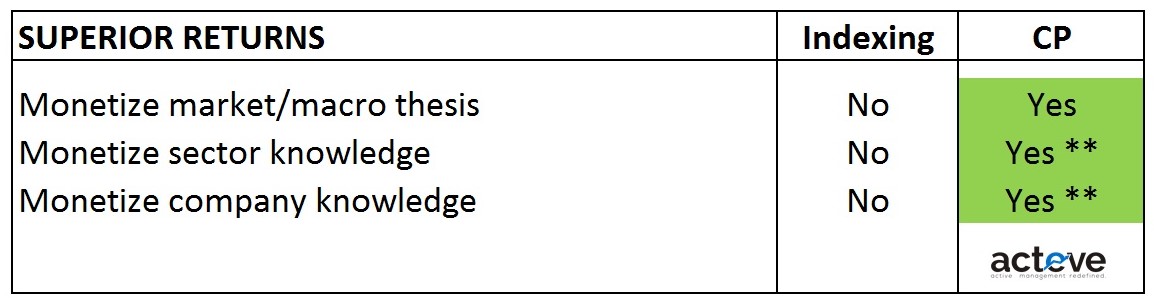

Thinking about risk in a vacuum is unlikely to provide an optimal solution to the investment problem. The table below compares value drivers between the two strategies. As you might expect, unless you are deliberately throttling cash in/out of your indexing ETF (i.e. actively managing), you have no way to monetize a macro view through indexing. Of course indexing also does not permit incorporation of sector-level or company-level knowledge or investment theses. All of this is possible and in fact a primary advantage of active management, including CP.

** acteve Model Portfolio – Concentrated Value Portfolio

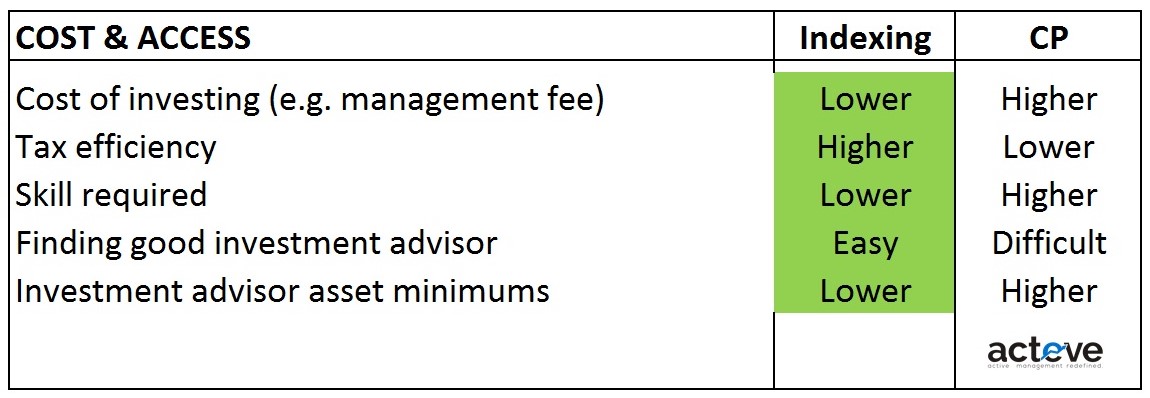

Depending on your level of assets available for investing and/or maturity of desire to invest, cost and access may carry more or less importance in your choice of investment strategy. As the table below suggests, indexing can relieve you of the difficult process of selecting individual stocks, or finding an active investment advisor, particularly if you have a limited level of assets to invest. I think this is especially applicable when comparing with active managers of the mutual fund variety.

** acteve Model Portfolio – Concentrated Value Portfolio

Mutual funds that invest in more than 50 securities in the portfolio will land closer to the indexing strategy, and consequently be viewed as high-cost indexers to be avoided. Hedge funds that take fewer positions will be viewed as pursuing a concentrated portfolio strategy, but may still be avoided in part due to higher fees. Of course you do not need to be organized as a hedge fund to pursue a CP strategy. Independent advisors can execute CP just as well if not better than hedge funds, with added emphasis on superior transparency, lower cost and investor education.

Robo Advisors typically pursue an asset allocation strategy in which they build portfolios comprised of multiple market indexes based on an investor’s risk profile, as measured by a limited and usually automated questionnaire. Essentially such a strategy assumes that historical asset correlations across different sectors or market indexes will hold true in the future and deliver predictable portfolio performance – a flawed or at least incomplete assumption in my view, considering that correlations tend to converge in times of market duress, arguably when you need diversification benefits the most (look back to the 2008 financial crisis as one example).

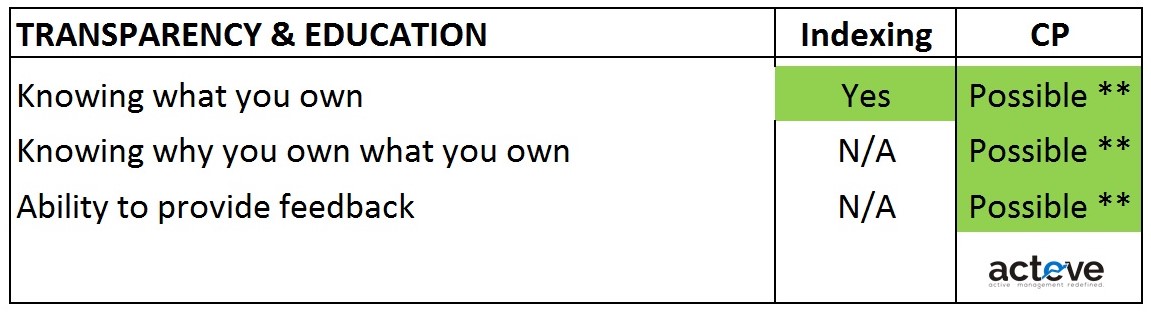

** acteve Model Portfolio – Concentrated Value Portfolio

Individual market indexes were never intended to deliver capital protection on their own. Instead, they were designed to provide a basis for gaining market exposure at lower cost. Deductively then, ETFs (and Robo advisors) seek to provide such market access at the lowest possible cost, and accordingly seem to be engaged in a race to the bottom on fees. Notice the emphasis on access and cost without mention of risk control, superior returns, capital protection, transparency or education? The latter is what you elect to give up by choosing to invest in an ETF or Robo advisor, whether this is proactively made clear to you by their providers or not.

Among all the different things an active manager does, perhaps the most difficult thing is to do nothing. It takes an incredible amount of effort to “do nothing”. All that work is needed to help you make sure you don’t look stupid in your own eyes, and wield the staying power to resist market forces seducing you to do something that in most cases isn’t in your best interest.

Disclosures and Disclaimer