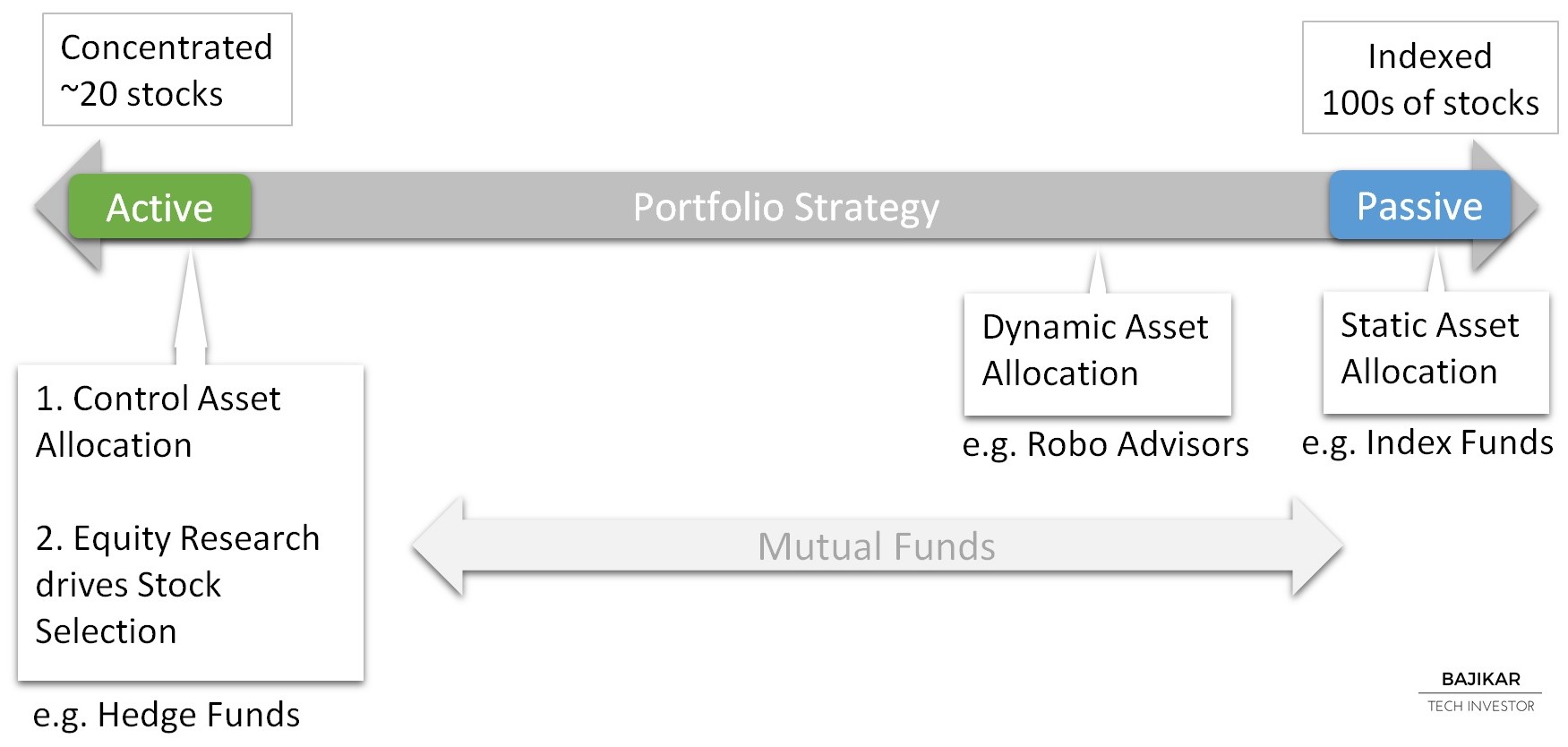

The acteve Model Portfolio (aMP) is an actively managed concentrated value portfolio. In the aMP, every aspect of the portfolio is controlled in order to accomplish the stated goal – One example of an investment goal would be to outperform the market (e.g. S&P 500 index) over rolling 5-year periods. Controlling the portfolio involves two major tasks – 1) determine asset allocation, and 2) select stocks/securities.

Asset allocation defines what portion of portfolio assets should be held in cash, invested in stocks, ETFs, MUNIs, short-term bonds, etc. Asset allocation is a function of many variables, which include a) view of the macroeconomic environment, b) general level of security valuations, c) general investor sentiment, etc. The most important outcome of asset allocation is to determine what portion of the portfolio will be held in cash. Such cash would be held in a money-market account until it is ready to be put to use.

Cash that is not “put to use” (i.e. invested in stocks/securities) undoubtedly weighs on portfolio upside to the extent market prices move higher, but importantly provides downside protection, for example at times of market volatility due to events like Brexit. Cash also provides valuable optionality to buy stocks at more attractive prices potentially as a result of market moving events. Not having access to cash when markets are artificially depressed would be an unfortunate handicap for a “Concentrated Value” investment strategy.

aMP is a “Concentrated Value” portfolio. This means that the portfolio holds a limited number of carefully chosen positions (e.g. ~20 stocks), with each stock position selected based on a disciplined process of Equity Research. Contrast this strategy with investing in a market index, through an ETF like IVV or VOO for example (both ETFs track the S&P 500 index). The S&P 500 market index comprises of 500 stocks. The proportion of each stock in the index is computed based on its market cap, and is not determined through Equity Research.

Passively buying the entire index is like walking into a grocery store and buying one of each item available, with no regard for need, quality or price. I don’t know anyone who does that in real life. Hypothetically, you might do something like this in the extreme event that no other alternative is available. Yet passive index investing through ETFs or Robo Advisors seems to be the rage these days, supposedly under an assumption that the bull market we have enjoyed for the last several years will continue indefinitely. If you think the bull market is not going to continue, will you opt to put your assets in an index-tracking ETF? Or are you swayed by the attractiveness of low fees?

The biggest problem with “passive” index investing, is probably that for most people it does not actually end up being passive. Unless you are mechanically making frequent and uniform contributions toward buying an index over long periods of time (many years/decades), without regard to anything occurring in the real world (e.g. wars, recessions, financial crises, etc.), you are not investing passively. By throttling your cash in or out of the market depending on your mood swings or “analysis”, you are actually being an active investor.

There are arguably good reasons for being a passive index investor – e.g. 1) you can’t be an active investor yourself and you can’t find a trusted investment advisor, 2) you are convinced that generally upward price movement of markets will continue over your investment horizon, 3) you are confident about your ability to not be a “backseat driver” by throttling cash in or out of the market, even if your portfolio value shrinks for one or more years at a time, 4) you are unable to get access to a particular market except through an index fund, etc. But trying to be a passive indexer mainly due to low perceived cost of the approach, without fully understanding the trade-offs or true economic costs, may not work in your favor.

By the way, what do you think would happen if everyone moved to indexing? It’s a legitimate question, though not one I would lose sleep over anytime soon. The answer I think is that liquidity in the market would disappear, and anyone stepping up to provide that market-making liquidity would stand to earn a huge premium – guess who that would be? Yes, an active investor.

If consistently done right, the promise of active investing is to achieve superior investment returns under any market conditions. The question for you is, how will you learn what “doing it right” means, and how will you know your investment advisor is doing it right?

acteve seeks to address these questions through active client education, maximum transparency, and ongoing engagement partnership as the “secret sauce” of superior long-term returns.

Disclosures and Disclaimer