Do the following investment objectives or actions resonate with you?

1. Enrich your financial advisor through high fees and trading commissions

2. Cede full control of investment account to advisor for advisor to “do what she wants” with the account

3. Take comfort in a “black box” investment strategy, having faith that it works, perhaps because you don’t fully understand it, nor can you easily describe it

4. Accept whatever investment performance or excuses your advisor offers periodically, trusting that must be the best anyone can possibly get

5. Choose an advisor based largely on which one has the coolest mobile app or website

6. Choose an advisor who convinces you that investment risk can be precisely measured and managed through complex mathematical models executed by machines

7. Choose an advisor who is keeping you mostly in the dark rather than actively educating you about your investments

8. Choose an advisor or seek investment or stock advice from individuals with little or no ability to execute independent equity research

9. Choose an advisor that doesn’t seek or care about your feedback

10. Choose the lowest cost advisor because the traditional model (e.g. mutual funds) isn’t working for you

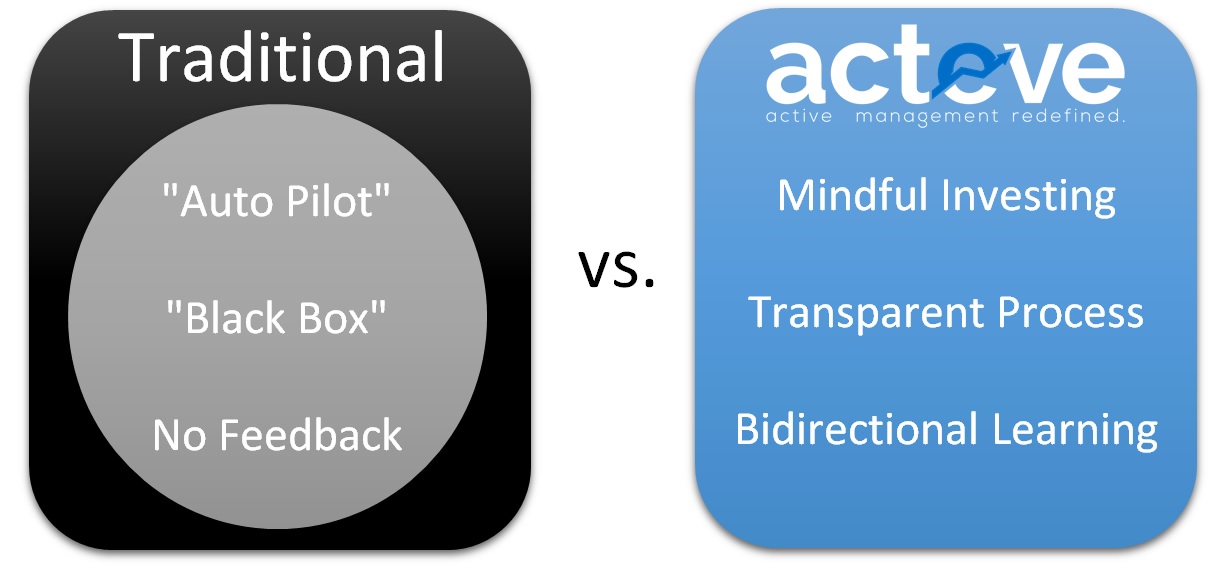

As you might have guessed, none of the above constitute mindful investing in my view. Now let’s compare the traditional model to acteve’s model below.

Traditional Model

The attributes listed below commonly apply to mutual funds and private wealth managers, among others.

1. Client gives custody of assets to custodian chosen by advisor

2. Advisor has discretionary trading authority in client’s separate or co-mingled account

3. Client pays commissions to advisor’s chosen broker/custodian

4. Client pays management fee to advisor

5. Advisor may provide quarterly newsletters with general views on the market and portfolio

6. Client is not actively encouraged to learn the investing process or become aware of investments in client’s portfolio

7. Client is not encouraged to provide feedback to advisor

8. Advisor effectively takes control of account away from client

The traditional model works well and is very lucrative for its providers, because a large number of professionals around the world decide to put their investments on “auto-pilot”, electing to give up their responsibility to be mindful of their investments.

acteve Model Portfolio (aMP)

The attributes listed below apply to the acteve Model Portfolio (aMP) advisory service offered by acteve LLC. acteve is redefining active management by putting you, the client, back in charge of managing your investments, based on advice provided by acteve.

1. Client keeps assets at client’s chosen custodian (e.g. a discount brokerage like Etrade, Interactive Brokers, Charles Schwab, etc.)

2. acteve does not accept discretionary trading authority in client’s account

3. Client pays trading commissions to client’s chosen broker/custodian

4. Client pays advisory fee to acteve for investment advice

5. acteve’s research blog provides access to industry and company research

6. acteve helps client learn the investment process

7. Client is encouraged to provide feedback to acteve

8. Client remains in full control of her account at all times

Mindful investing involves knowing what you are investing in and for what reason. Mindful investing also involves remaining in control of your investments, seeking out investment advice while maintaining control over your investment decisions. Additionally, mindful investing involves giving feedback to your advisor. Thus mindful investing requires you to take responsibility and become accountable to yourself for your investments.

Would you like to be a mindful investor?

Disclosures and Disclaimer