SYNA stock is down ~25% YTD, trading at EV/S of ~1x (vs. peer group at ~3x+), a valuation discount worth exploring. Synaptics was affected by

Category: Self-Driving Car

FCAU (Fiat Chrysler Automobiles) appears to be attracting attention recently, with the stock up ~27% over the last 3 months vs. S&P 500 index up

Both AMD and NVDA offer exposure to GPU Compute, arguably a very desirable capability with growing applications in artificial intelligence, AR/VR and self-driving car. Both

My view is that catalysts for self-driving cars will also drive a transition to battery-powered electric vehicles. A shift from human driver to machine driver

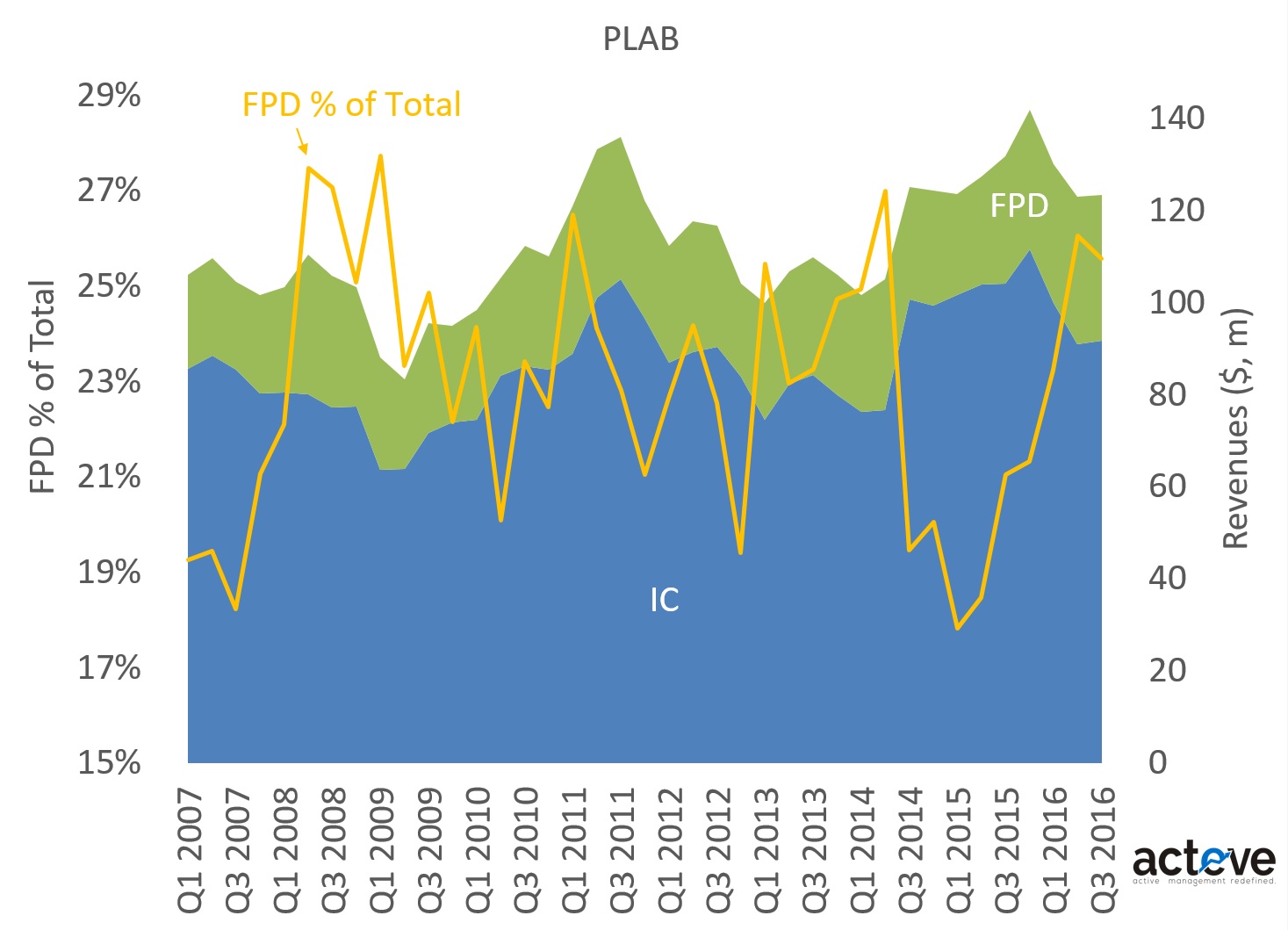

Photronics (PLAB) makes photo masks for semiconductor and display panel manufacturing. The chart below shows PLAB’s revenue mix. Over the last 6 quarters, flat-panel display

The chart below suggests that INVN stock price is tracking below NTM EPS projections, an understandable dynamic following severe dislocation in Invensense’s gyro/OIS market share,

I believe there are 3 reasons to continue to own $MU: 1) early stage of a cyclical recovery, 2) technology catch-up, and 3) inexpensive play

When a relatively recent IPO is trading at ~30x Revenues (MBLY traded at EV/S TTM multiples of ~25x to 100x since IPO), is owned by

The popular name for Convolutional Neural Network (CNN) these days is “Deep Learning” (DL) or Deep Neural Network (DNN). Researchers at Google, Facebook, IBM, Nvidia,

Well, clearly not safe enough to deal with a high-riding tractor trailer at freeway speeds, yet. Media reports suggest a self-driving Tesla (on “autopilot”) was