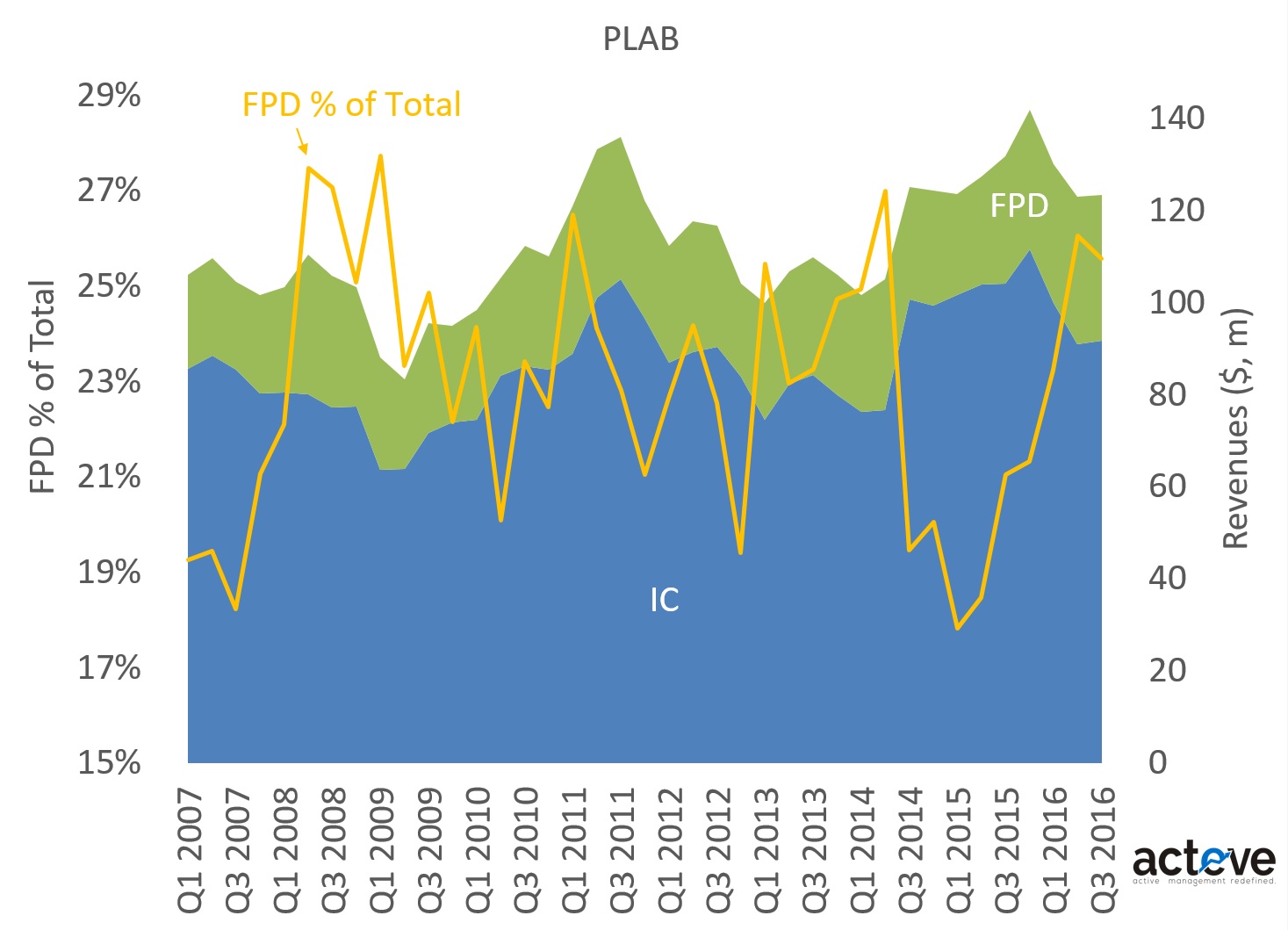

Photronics (PLAB) makes photo masks for semiconductor and display panel manufacturing. The chart below shows PLAB’s revenue mix. Over the last 6 quarters, flat-panel display

Year: 2016

The chart below suggests that INVN stock price is tracking below NTM EPS projections, an understandable dynamic following severe dislocation in Invensense’s gyro/OIS market share,

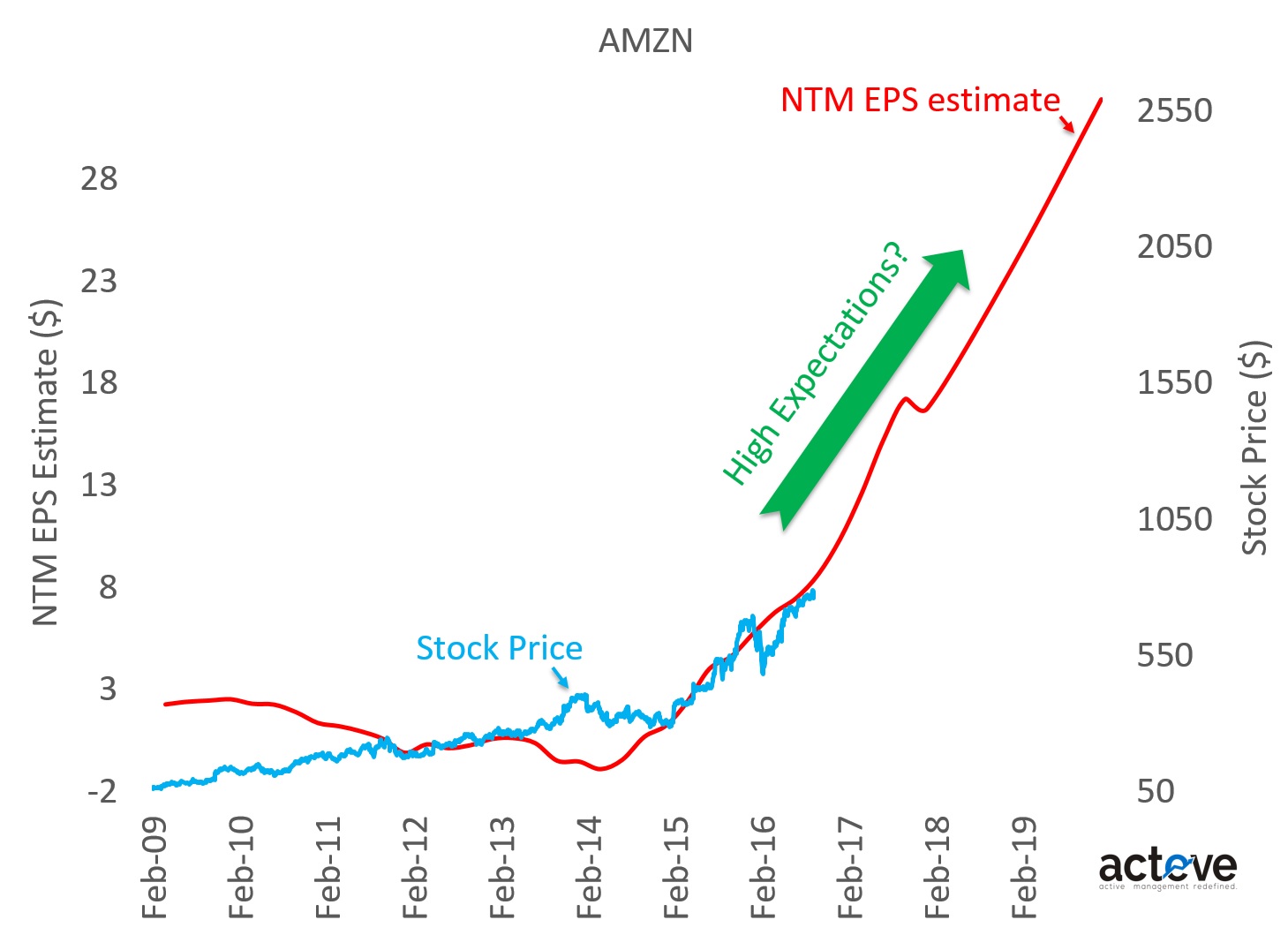

Let’s assume that sellside estimates are representative of investor expectations for $AMZN (as discussed in my book, that is not always the case). The NTM

I believe there are 3 reasons to continue to own $MU: 1) early stage of a cyclical recovery, 2) technology catch-up, and 3) inexpensive play

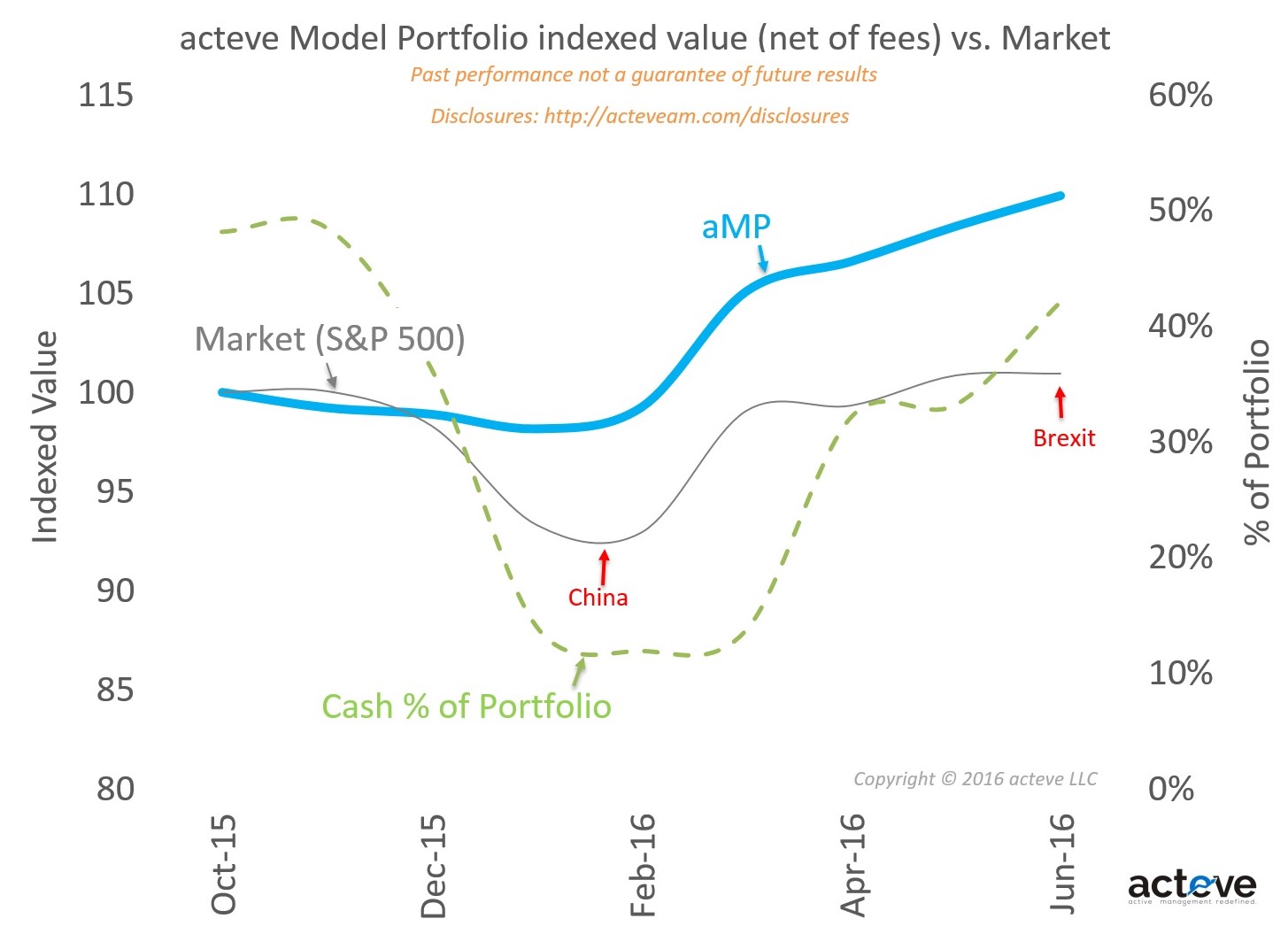

The chart shows acteve Model Portfolio (aMP) indexed value (net of fees) vs. the S&P 500 market index (indexed to 10/31/15), as of 6/30/16. The

acteve LLC is a new type of investment advisory firm which focuses on just the function that individual investors (and many professional investors) would find

I previously wrote that there are essentially 4 ways to beat the market, one of which is Institutional Arbitrage. Probably the simplest way to think

The $INFN PAM-4 boogeyman was probably born at the time PAM-4 was first conceived a couple of years ago. However the PAM-4 scare appears to

“Corporate Governance” represents a broad category of issues that typically indicate some form of mismanagement at a company. Investors become concerned when they do not

When a relatively recent IPO is trading at ~30x Revenues (MBLY traded at EV/S TTM multiples of ~25x to 100x since IPO), is owned by