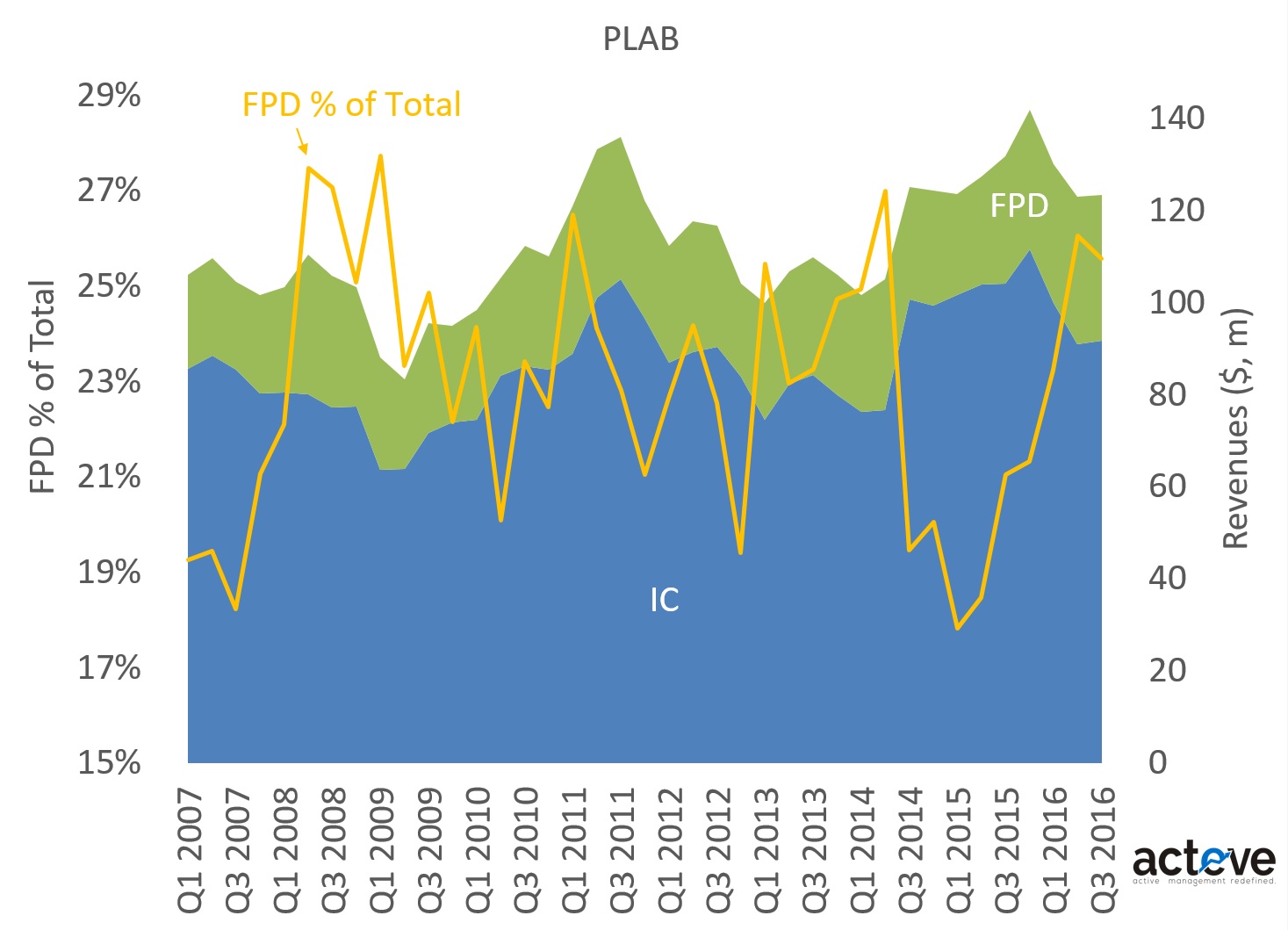

Photronics (PLAB) makes photo masks for semiconductor and display panel manufacturing. The chart below shows PLAB’s revenue mix. Over the last 6 quarters, flat-panel display (FPD) revenues have grown on average at 18% YoY, while IC revenues grew at 4%. If the display industry inflects toward AMOLED, as I think it is likely to, PLAB’s FPD-driven growth would continue.

One reason to consider a display inflection from LCD to AMOLED is that VR/AR requires higher quality displays than those found on the iPhone 7/Plus. If AMOLED displays are cost competitive with LCD, then there shouldn’t be a reason to hold back superior technology any longer. Some investors are expecting at least one model of the next iPhone in 2017 to sport an AMOLED display made by Samsung. This is something my own research suggested as early as a couple of years ago. At its analyst day held yesterday, Applied Materials suggested that OLED penetration of Smartphone would increase from ~20% in 2016 to ~36% in 2018 and ~55% in 2020, as an increasing portion of the ~15-20 new display factories Applied expects to be built over that period transition to OLED.

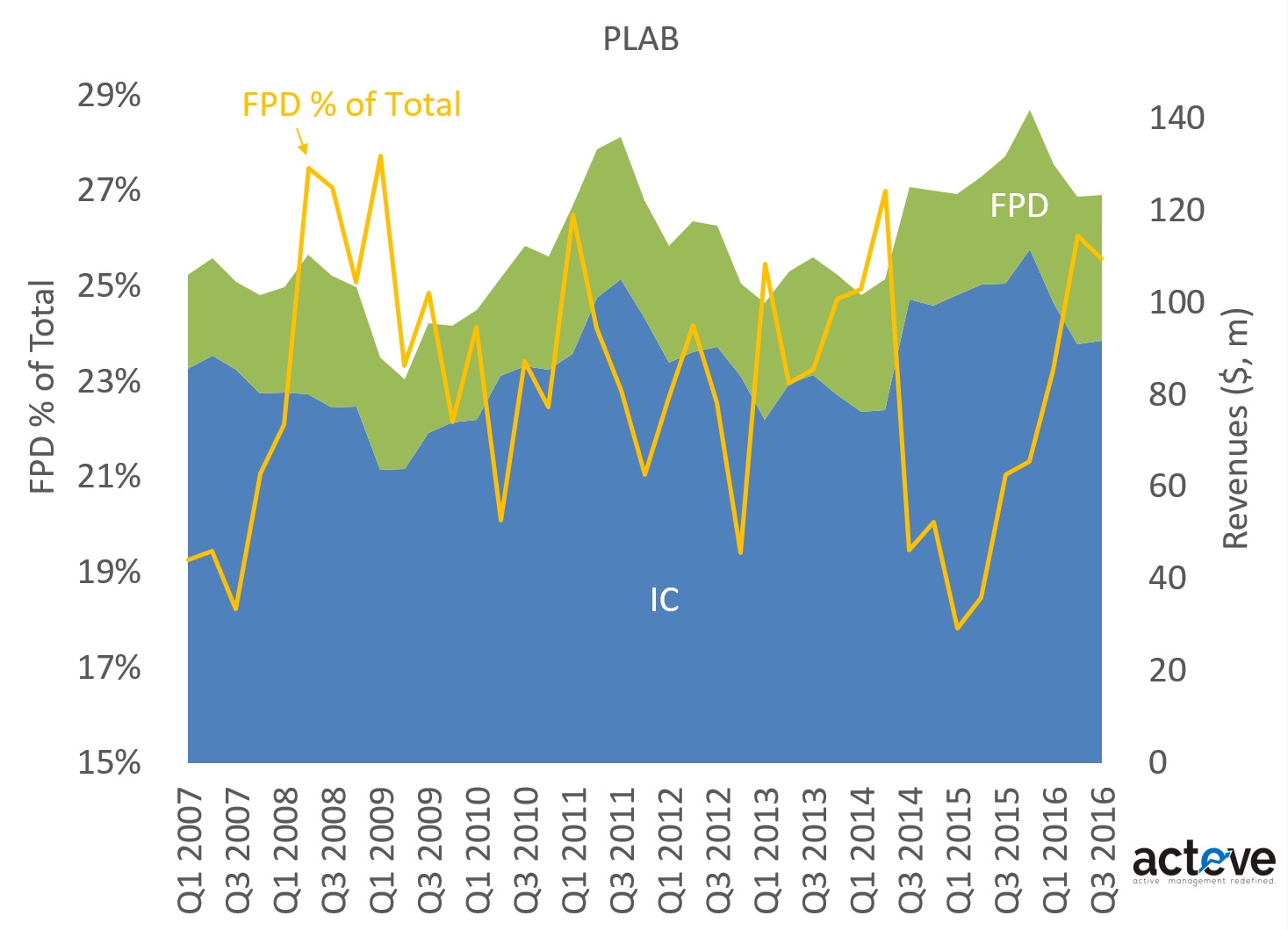

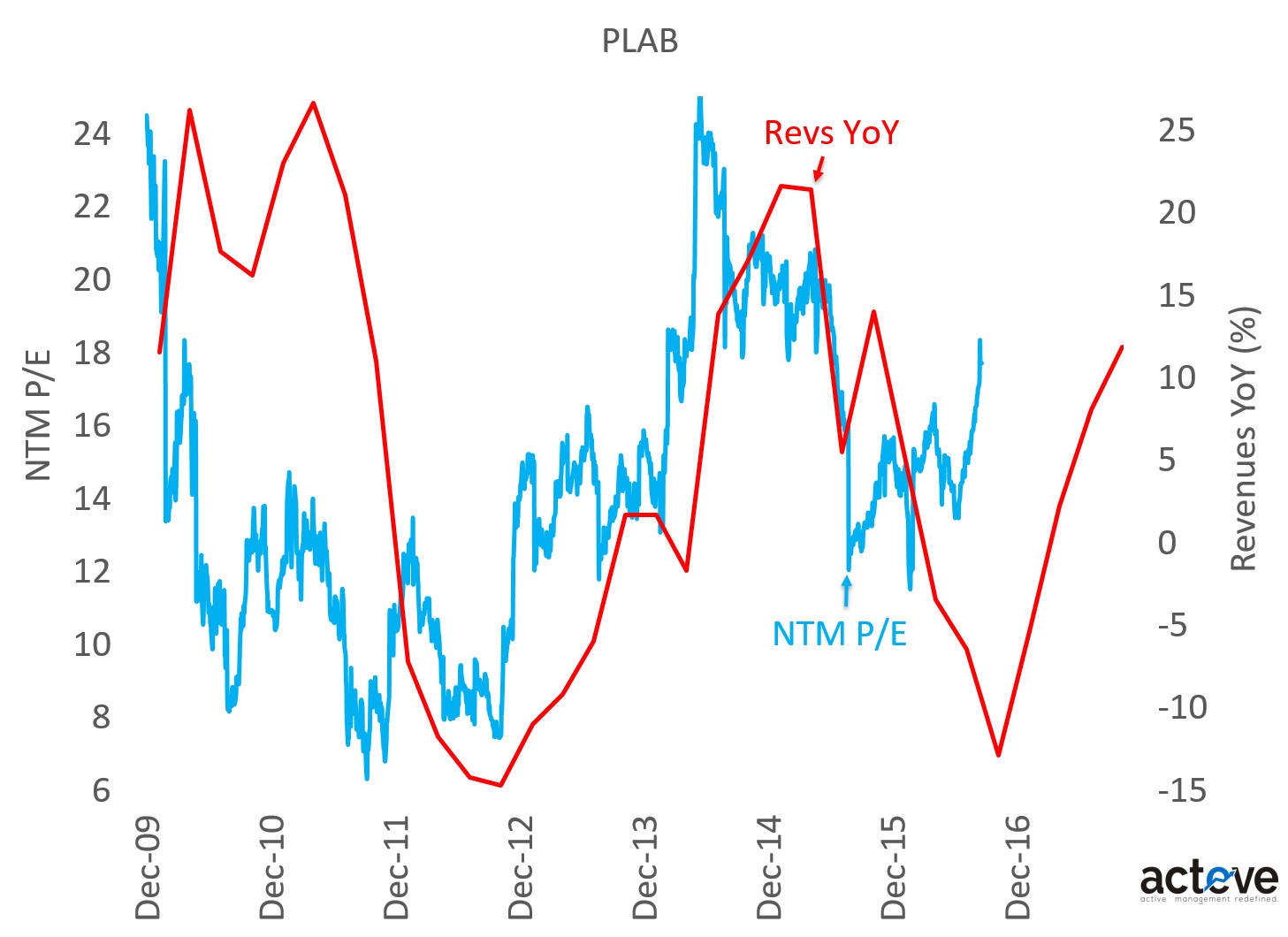

PLAB’s largest customers include Samsung Electronics, LG Display, Micron, Globalfoundries, UMC, and Intel. As shown in the chart below, a combination of near-term transitions at one or more Samsung AMOLED factories, and an expected JV transition at Micron caused revenues to decelerate recently, driving stock price lower. PLAB stock has declined by ~18% YTD. As the chart suggests, sellside estimates appear to be factoring in a recovery in YoY revenues after a dip in 2H16.

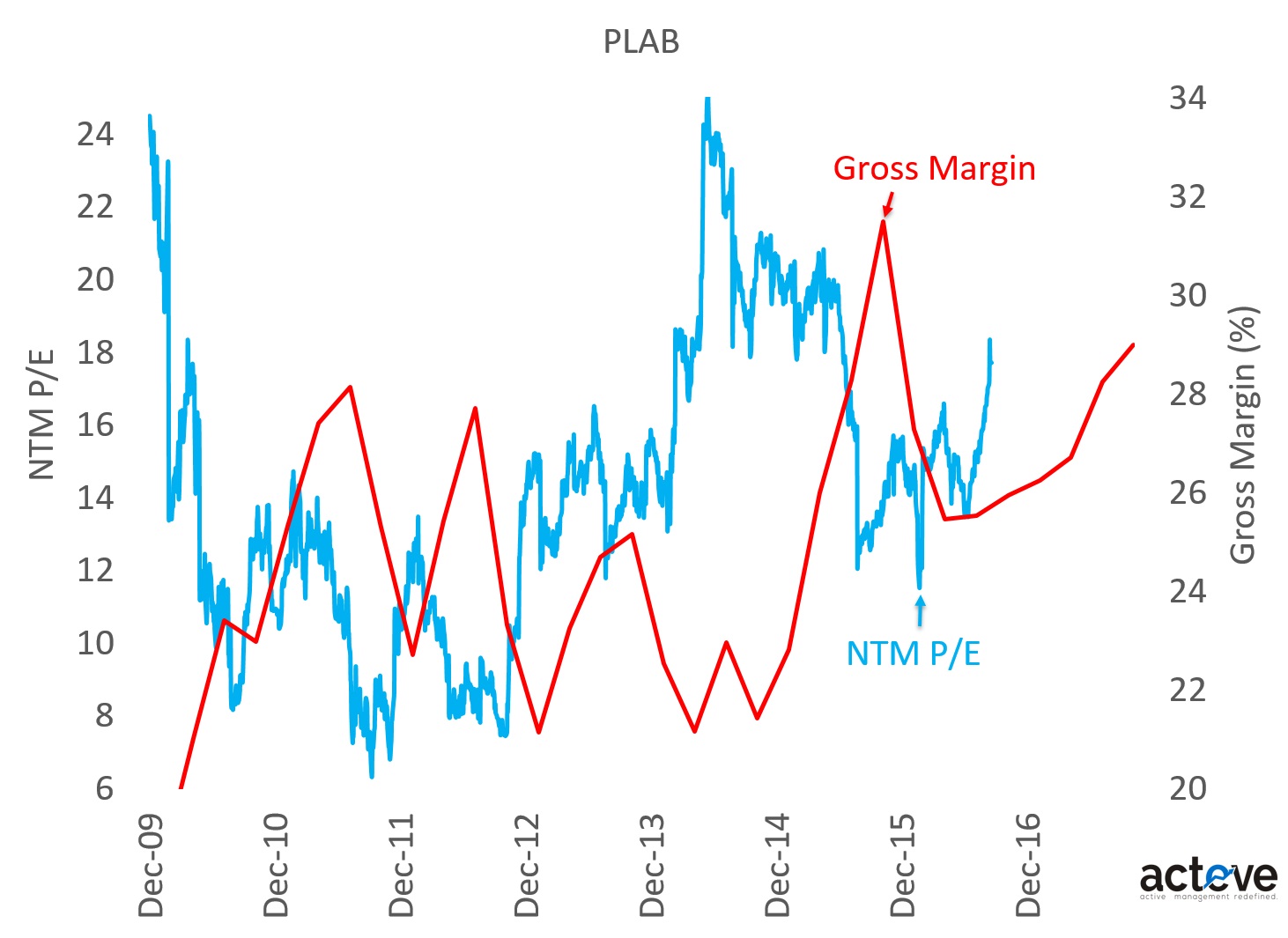

Over the last decade PLAB appears to have improved its competitive position by strategically investing in advanced technology at a higher pace compared to its primary merchant competitors DNP, Toppan and Hoya in Japan. PLAB’s gross margin improvement illustrated in the chart below is supportive of PLAB’s stronger industry position. According to the company’s most recent investor presentation, PLAB is either already the largest merchant provider of masks by market share, or on track to become the largest provider.

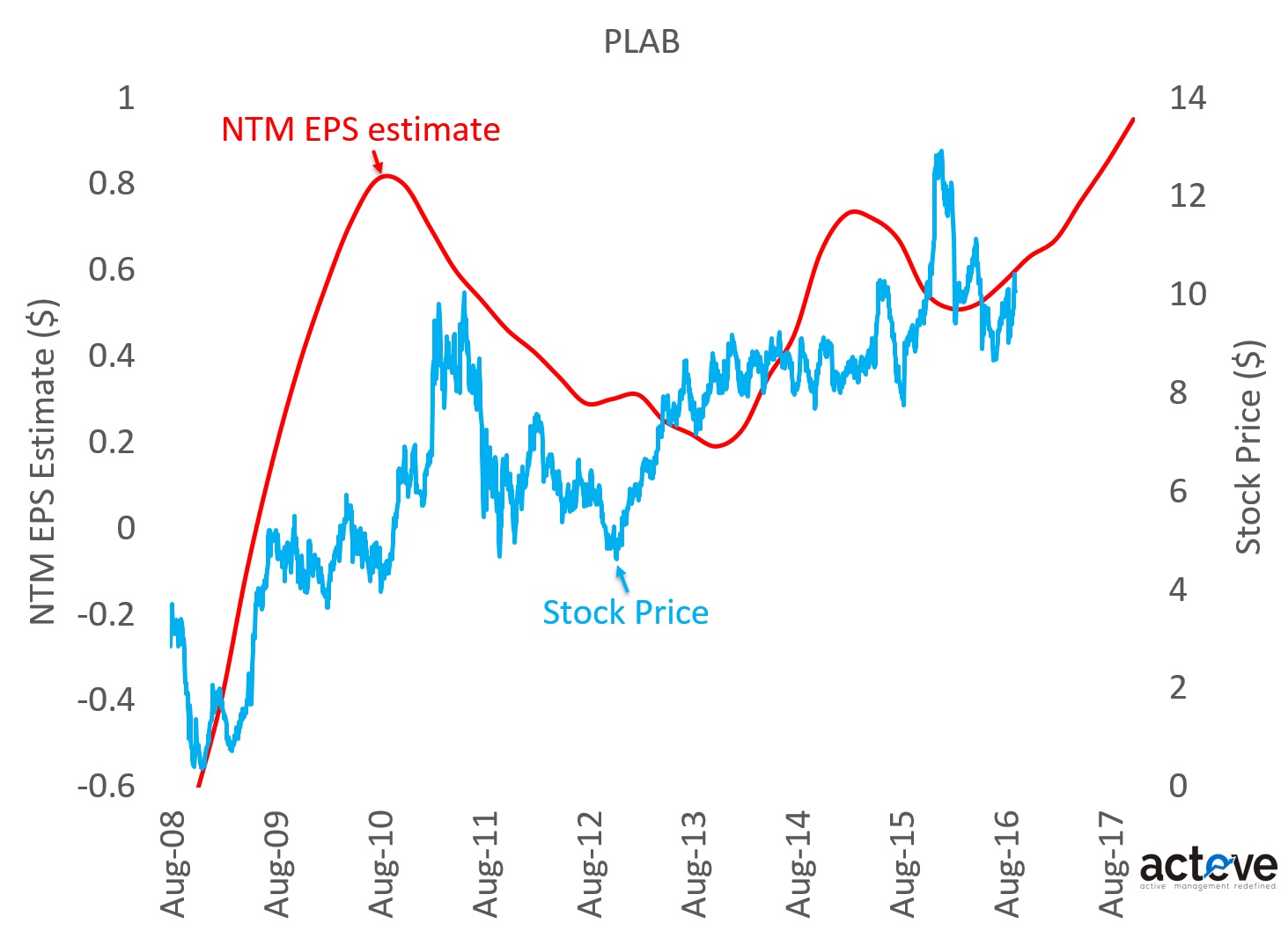

The chart below suggests PLAB stock price is tracking NTM EPS estimates closely, and that the street is expecting EPS to increase over the next twelve months after a recent trough.

PLAB management has been quite vocal about the upcoming “wave of OLED”. Here are a few management quotes extracted from recent call transcripts:

“Right now for mobile displays, AMOLED represents a little less than maybe 20% of the overall market. But it’s become very clear I think to everyone that the A company is going to need to transition their display technology. That’s going to require a tremendous amount of capacity.”

“What occurred during the quarter is one of our largest customers in Korea announced they were literally taking a traditional alpha-silicon large-format display factory off line, and converting it to AMOLED. That’s a short-term negative for us; but you can see that we shifted during the quarter the business to keep our tools full. Anyway, it’s a short-term negative, but next year, early spring, when that factory is starting to crank out AMOLED displays, it should be a significant positive for us, given our position with that customer.”

“But I would guess by the time 2018 rolls around, the fraction of mobile displays that are built with AMOLED technology will likely double, approximately. That’s a huge shift, a lot of business. We think we’re positioned very well to exploit that shift.”

“Right now our memory business isn’t strong. We were able to cover it in the quarter, as we projected, with our high-end logic IC business as well as our mainstream. That was no small feat, so I’m very pleased with how the team executed there. Certainly as we move into 2017, we expect a reversal of what has been a couple quarters of negative head winds in that business to be tail winds.”

“it’s pretty clear that DRAMs finally bottomed out. As the DRAM market recovers, what we expect to see is a build-back of — both a build-back of our existing foundry memory business, as well as some new revenues from new customers that are leveraging the Micron bit cell”

“Moreover, our balance sheet affords us options that were not available in the past, including M&A to consolidate the photomask industry, as well as explore potential adjacencies to diversify revenues. It is truly an exciting time at Photronics. I look forward to updating you as we progress.”

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosure: As of this writing the acteve Model Portfolio (aMP) held a long position in PLAB.

Additional Disclosures and Disclaimer

Stock market data provided by Sentieo.