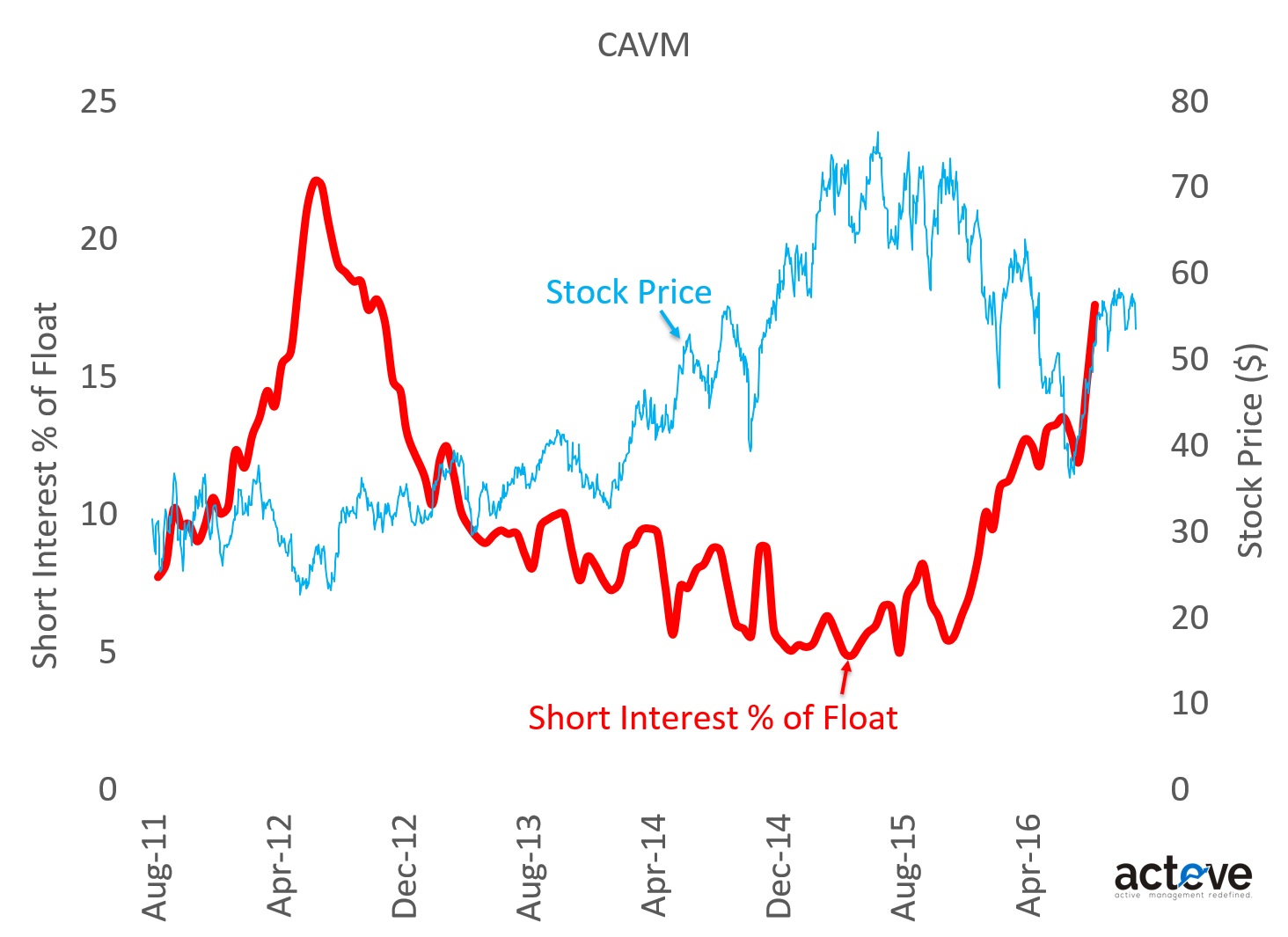

$CAVM traded down ~5% the day after the company reported a 3Q16 beat both on earnings and 4Q16 guidance. The chart below suggests short interest in the stock has increased to 17% of float (from 12%) over the last few months, and is up from ~7% about a year ago. This means there is a shorting party in progress, and the outline below is an exercise in interpreting the short case for CAVM.

Here are a few arguments that potentially make up the short case:

1. Unexpected demand pull-in (LiquidIO, OcteonFusion) into 2H16 will be followed by a weaker 1H17

2. Misexecution on ThunderX and/or Xpliant translating to slower product ramps

3. Higher Server competition from AMD in 2017

4. Higher competition from Broadcom+Brocade

5. Valuation multiple compression due to some combination of revenue deceleration, margin compression, excessive cash flow to employees rather than shareholders, macro, etc.

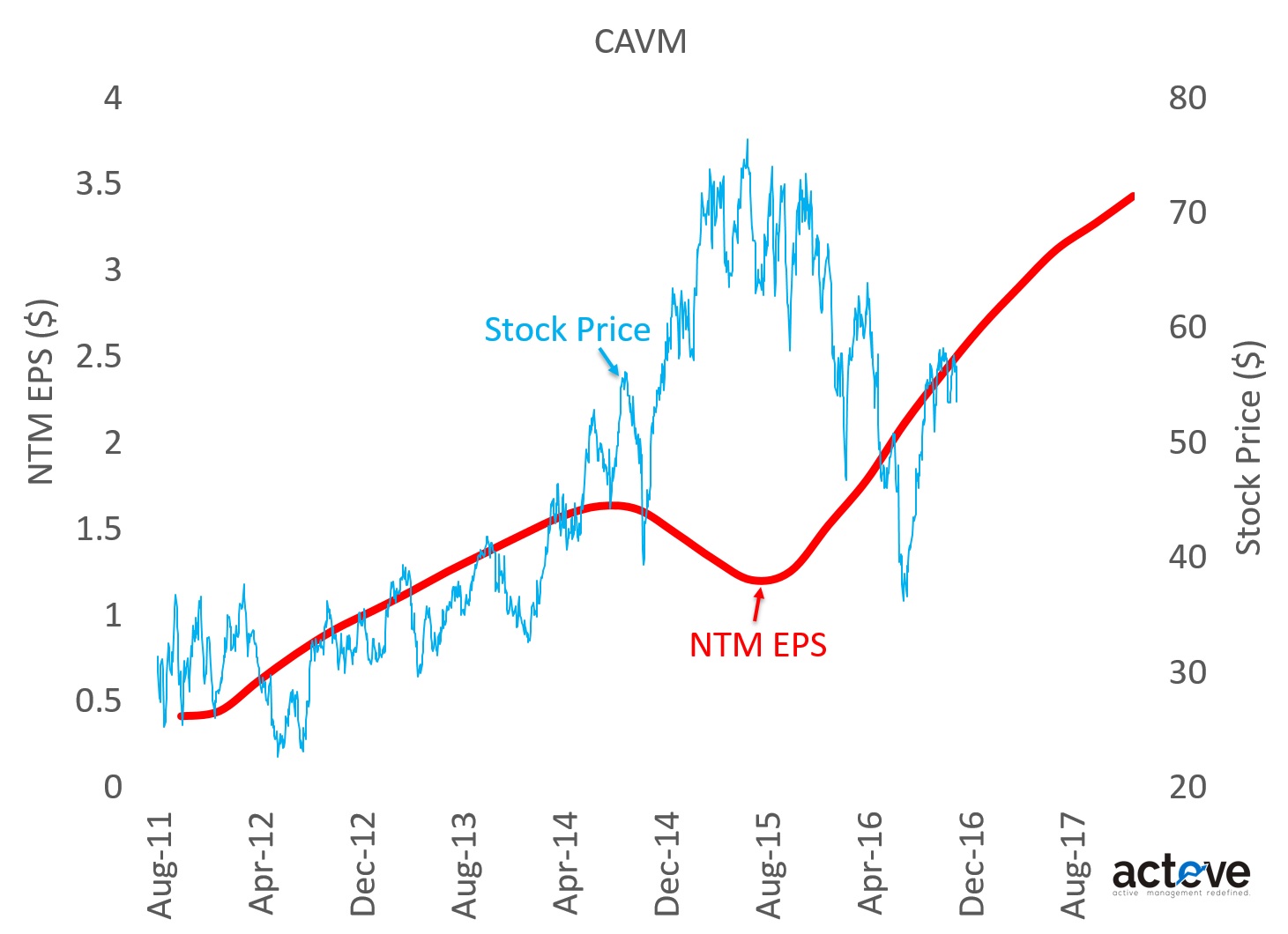

In comparison, the long case for CAVM I think is rather simple – continued strong double-digit growth at or above peer group average margins. In the end investors often come to realize that growth will always carry a premium, because consistent growth over many years is hard to find. In the interim, many short-term-oriented market participants may find it easy to short the stock on valuation, given the stock does not look severely undervalued at current levels. The chart below suggests CAVM stock is tracking NTM EPS projections closely, after a dip around the QLGC acquisition earlier this year.

On its 3Q16 earnings call, Cavium reported stronger than expected fundamentals as below:

1. LiquidIO reacceleration

2. Sharp ramp of OcteonFusion in India, Japan and South Korea

3. Qlogic projections looking better than pre-acquisition due diligence

4. Continued strong design win traction across the board for ThunderX, Xpliant and other products.

Essentially the shorts are saying that forward projections for CAVM are too optimistic. In reality there is no way for anyone (except perhaps company management) to know this in advance, given the company’s arsenal seems to be well armed with multiple growth-seeking new products.

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosure: As of this writing the acteve Model Portfolio (aMP) held a long position in CAVM.

Additional Disclosures and Disclaimer

Stock market data provided by Sentieo.