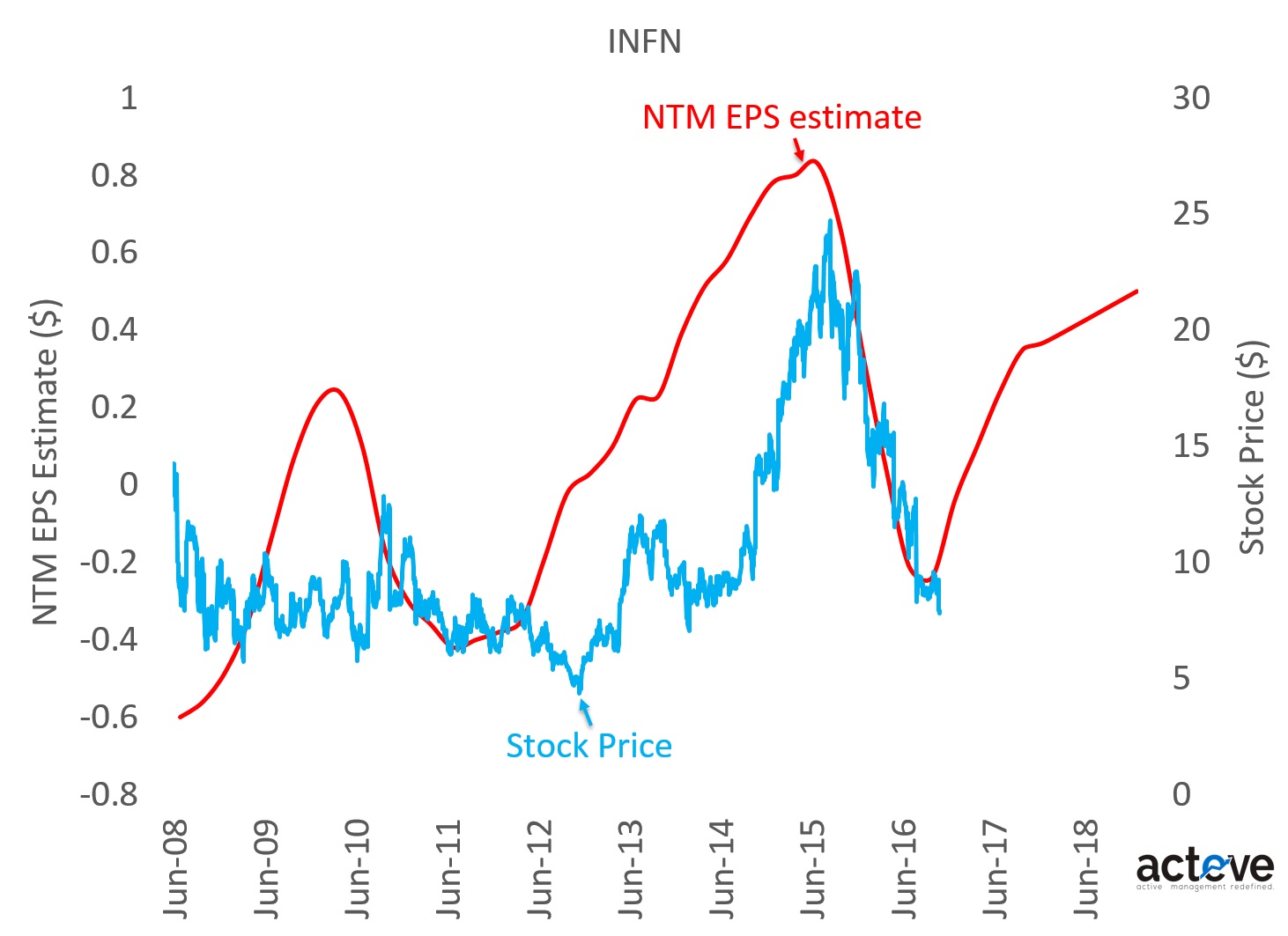

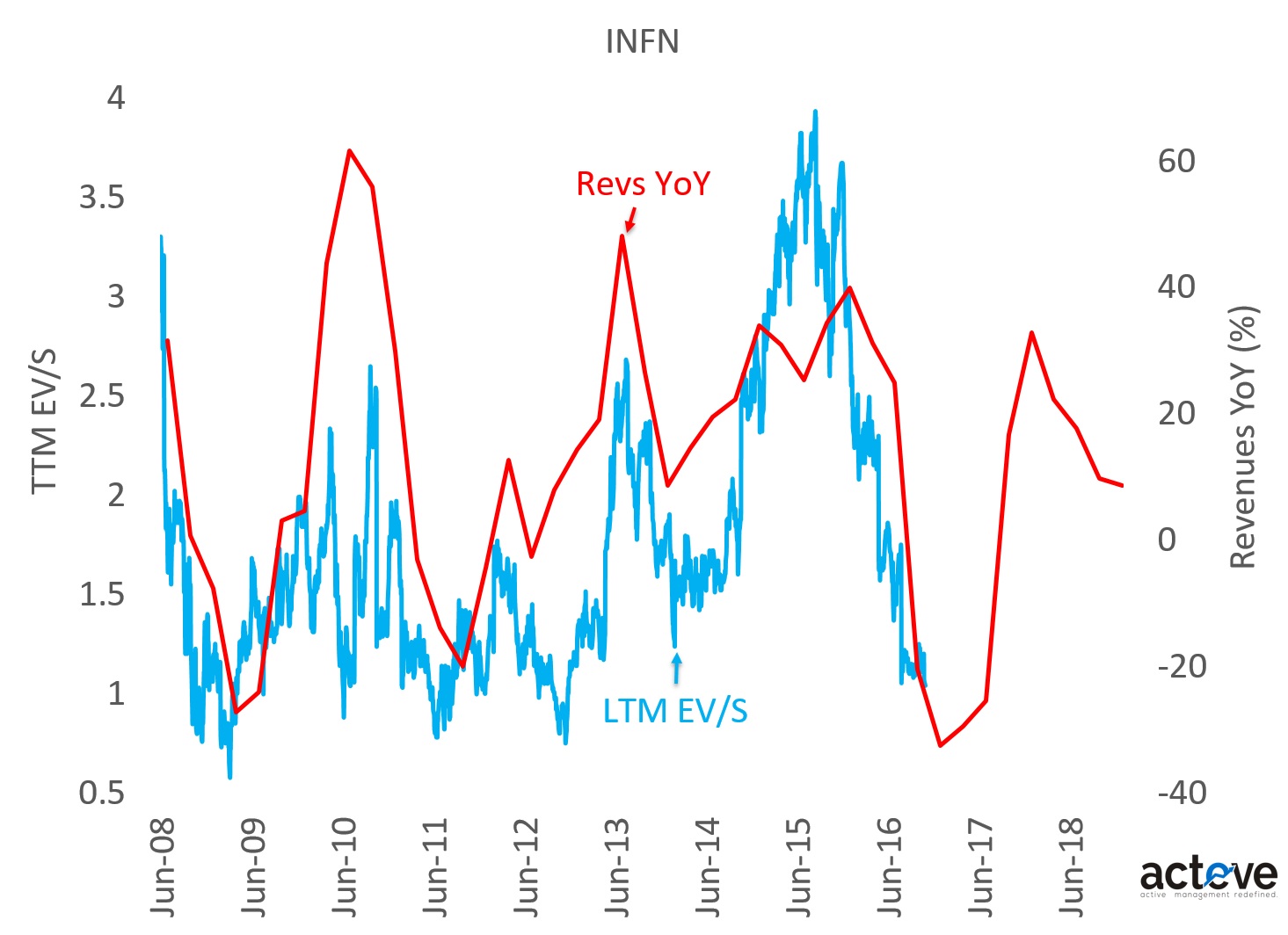

INFN stock is down ~50% YTD driven by sharp YoY declines in revenues and earnings (see chart below). Both company management and investors seem to be surprised at the extent of revenue declines, which after progressively worsening have driven INFN’s EV/S valuation multiple near ~1x.

This level of stock decline typically carries with it loss of investor confidence, a dynamic that serves to depress valuation more than might be warranted by fundamentals (chart below). Understanding how the company got here is an important step in interpreting a path to recovery.

Infinera’s revenue problems appear to be centered in its subsea and longhaul businesses, which together generate ~60% of revenues. Accordingly a recovery in these businesses would be capable of driving intrinsic value higher.

Here are a few things to consider:

1. Longhaul business is cyclical & long-term opportunity is robust

Looking at the charts it should be obvious that Infinera’s business has been cyclical, and Infinera previously experienced similar types of revenue declines most recently in 2011 and 2008. Recent management commentary suggests a spending pause by customers, a change that is probably affecting others like Ciena, even if to a smaller extent.

2. Subsea business is driven by advanced technology, which Infinera plans to introduce soon

Infinera management has been transparent about the company’s misjudgment of investment priorities in DSP technology, effectively causing the company to lose its traditional competitive advantage in this area. Management has also telegraphed upcoming announcements (perhaps at analyst day next week) about its “Gen4” Infinite Capacity Engine (ICE) platform with DSP capabilities that would allow the company to regain footing in subsea, and participate in a multi-year investment cycle by Cloud companies like Facebook.

3. DCI long-term path seems to be toward coherent

Market noise about Coherent vs. Direct detect/PAM4 notwithstanding, industry participants seem to be focused on building capabilities in Coherent – an area which Infinera has technologically led in for many years. Consider the following recent updates:

– Inphi’s acquisition of Clariphy for ~5x sales serves as a data point of validation. Inphi gains coherent DSP capability, which has been the cornerstone of Infinera’s competitive advantage, more recently mimicked by Ciena in subsea, as well as by Acacia in Metro/DCI.

– Acacia CEO recently said: “So coherent is the direction that all the networks are going. And whether you talk ACO, DCO, they acquire either the DSP plus the transport, which is in the silicon photonic piece, or in some cases just the silicon photonic. And so, Acacia has both the components that is required to participate in all of these markets … You do hear about other technologies, like PAM-4, which are more short reach. Because that is direct detect, it doesn’t offer you the automated dispersion compensation and others that coherent does. So there is a place for it in the network, but even including all the webscale players, they all need coherent technology for going through the data center interconnect distances and beyond.”

– Lumentum (LITE) management’s recent quote: “We were aware of the opportunity and we are pleased to see it announced at OFC timeframe, back in I guess it was March. Inphi did a great job in the technology side of things and, from our perspective, when we looked and analyzed the opportunity, we felt it was relatively niche-y compared to some of the other customer opportunities that are coming our way. And, therefore, we chose to focus heavily on cost reducing and driving size reduction and power reduction on clearance solutions as well as pushing bandwidth up considerably … So, more power to them; I think it’s largely focused on the Microsoft opportunity”

As the EV/S vs. revenues YoY chart suggests, a YoY revenue inflection over the next ~6 months could catalyze multiple expansion. As is usually the case, investors tend to get paid when confidence builds around a recovery, many times in advance of an actual recovery for companies that aren’t viewed as chronic misexecutors.

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosure: As of this writing the acteve Model Portfolio (aMP) held a long position in INFN, but no position in IPHI, CIEN, ACIA or LITE.

Additional Disclosures and Disclaimer

Stock market data provided by Sentieo.