SYNA stock is down ~25% YTD, trading at EV/S of ~1x (vs. peer group at ~3x+), a valuation discount worth exploring. Synaptics was affected by

Category: VR/AR

Both AMD and NVDA offer exposure to GPU Compute, arguably a very desirable capability with growing applications in artificial intelligence, AR/VR and self-driving car. Both

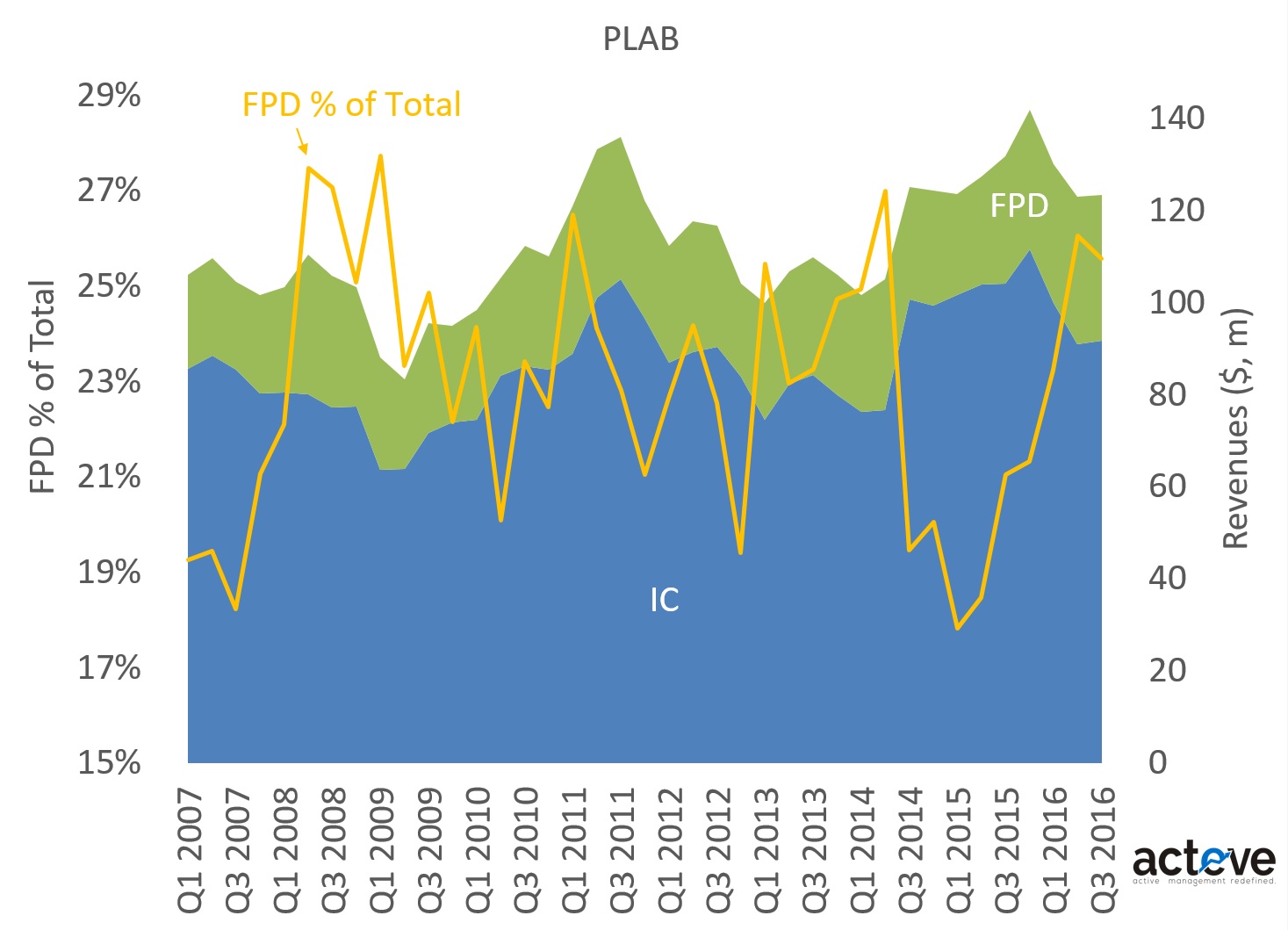

Photronics (PLAB) makes photo masks for semiconductor and display panel manufacturing. The chart below shows PLAB’s revenue mix. Over the last 6 quarters, flat-panel display

The chart below suggests that INVN stock price is tracking below NTM EPS projections, an understandable dynamic following severe dislocation in Invensense’s gyro/OIS market share,

I believe there are 3 reasons to continue to own $MU: 1) early stage of a cyclical recovery, 2) technology catch-up, and 3) inexpensive play