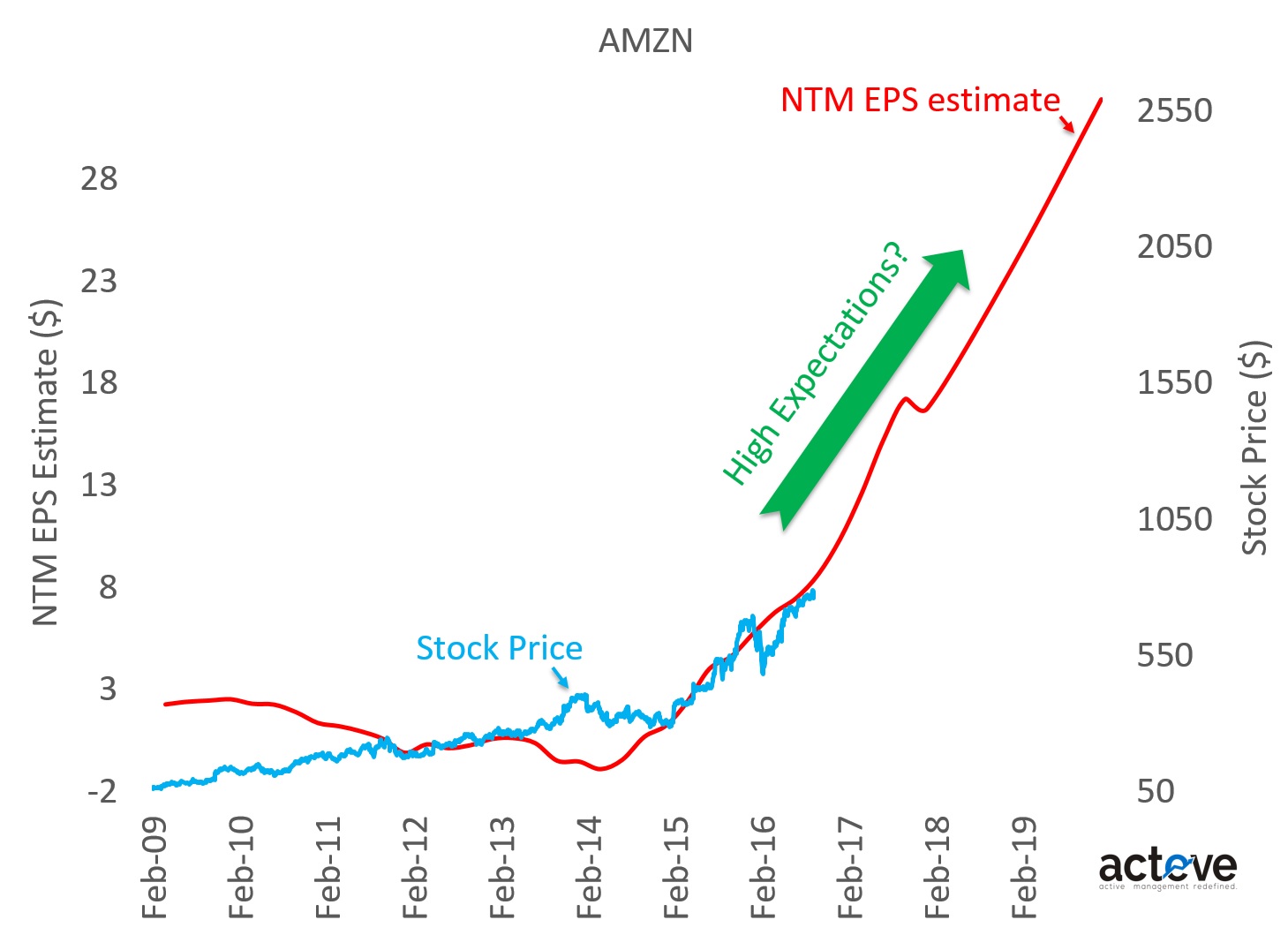

Let’s assume that sellside estimates are representative of investor expectations for $AMZN (as discussed in my book, that is not always the case). The NTM

Category: Stock Analysis

I believe there are 3 reasons to continue to own $MU: 1) early stage of a cyclical recovery, 2) technology catch-up, and 3) inexpensive play

The $INFN PAM-4 boogeyman was probably born at the time PAM-4 was first conceived a couple of years ago. However the PAM-4 scare appears to

“Corporate Governance” represents a broad category of issues that typically indicate some form of mismanagement at a company. Investors become concerned when they do not

When a relatively recent IPO is trading at ~30x Revenues (MBLY traded at EV/S TTM multiples of ~25x to 100x since IPO), is owned by

As the chart illustrates, according to inSpectrum, 4Gb DDR3 DRAM spot prices increased by 5% MoM in June, with June ending prices ~15% higher than

Maybe, but likely in a different way than Facebook or LinkedIn. You really have to use Twitter to understand the difference. Whereas connections on Facebook

The chart shows that short interest (number of shares sold short as a % of float) in CAVM started increasing in late-2015, and remained elevated

I had started to think of CAVM as a value stock (see prior article here), but with the QLGC acquisition announced, there are a few

Software as a Service (SaaS) is a relatively new breed of Cloud-based software apps that seek to: 1) provide superior capabilities compared to traditional desktop