Stock Prices can be linked to business fundamentals through one or more Valuation Metrics. When a given valuation metric is found to track (i.e. correlate

Category: Stock Analysis

SYNA stock is down ~25% YTD, trading at EV/S of ~1x (vs. peer group at ~3x+), a valuation discount worth exploring. Synaptics was affected by

FCAU (Fiat Chrysler Automobiles) appears to be attracting attention recently, with the stock up ~27% over the last 3 months vs. S&P 500 index up

Earlier this week Micron increased its earnings guidance for the quarter ending Nov-16, to be reported later this month. Revised guidance is for revenues and

INFN stock is down ~50% YTD driven by sharp YoY declines in revenues and earnings (see chart below). Both company management and investors seem to

I previously wrote about AMZN valuation risk here, and valuation will often be a concern for high-growth companies. Implicit in that view is a concern

$CAVM traded down ~5% the day after the company reported a 3Q16 beat both on earnings and 4Q16 guidance. The chart below suggests short interest

Both AMD and NVDA offer exposure to GPU Compute, arguably a very desirable capability with growing applications in artificial intelligence, AR/VR and self-driving car. Both

Micron’s F4Q16 (C3Q16) earnings report highlights a YoY revenue inflection (chart below), with YoY revenue growth expected to turn positive next quarter. Both higher bit

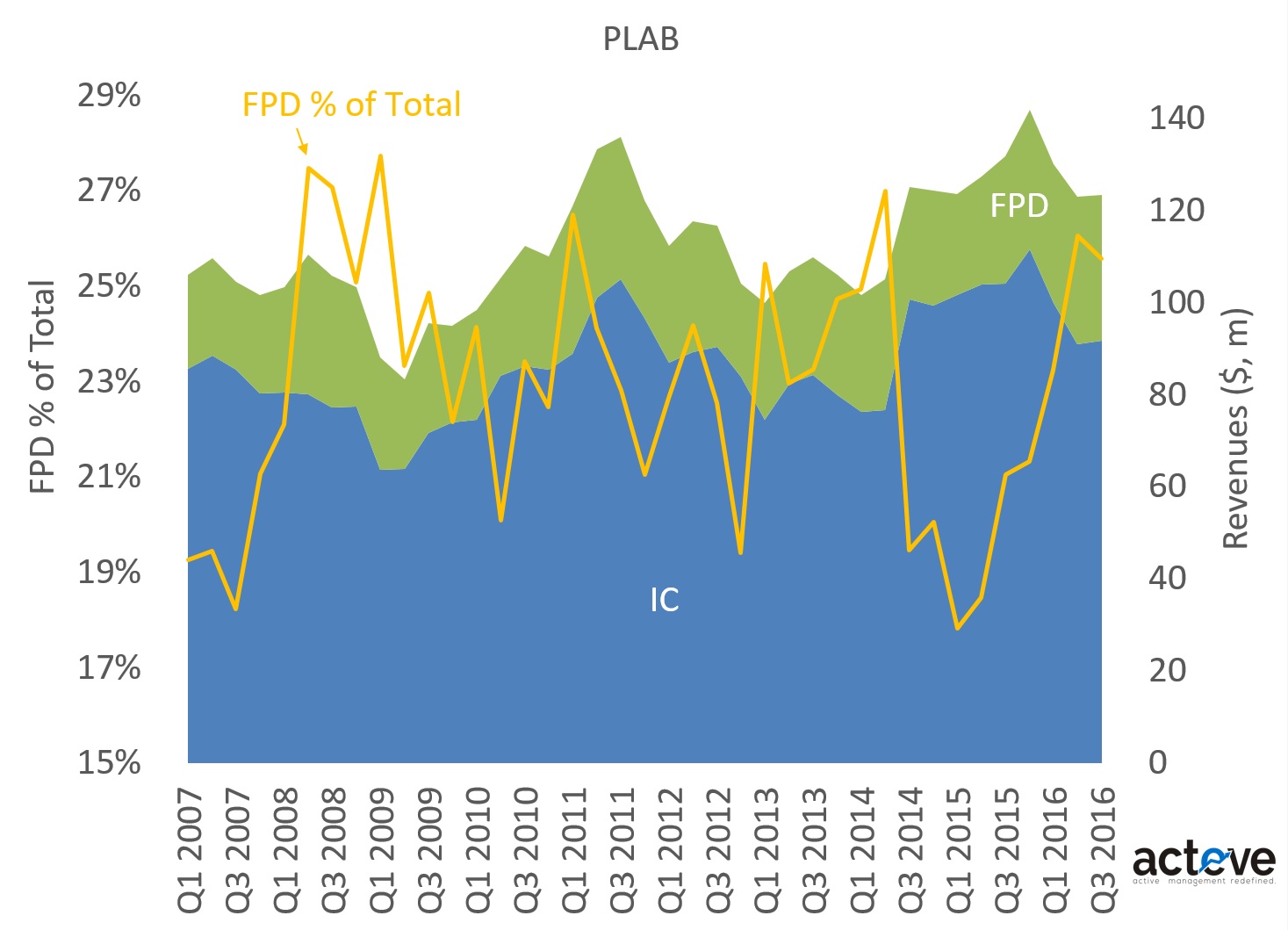

Photronics (PLAB) makes photo masks for semiconductor and display panel manufacturing. The chart below shows PLAB’s revenue mix. Over the last 6 quarters, flat-panel display