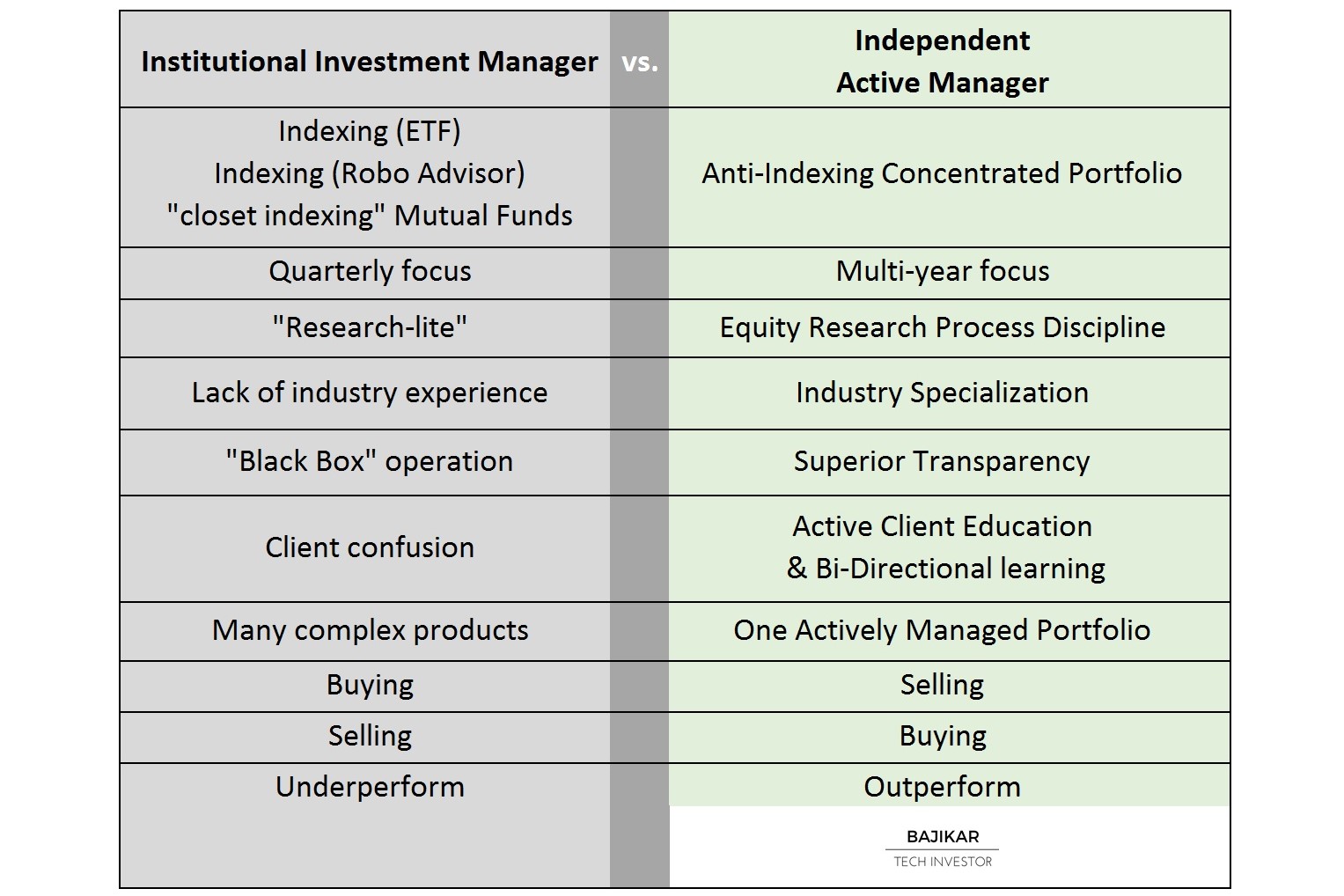

I previously wrote that there are essentially 4 ways to beat the market, one of which is Institutional Arbitrage. Probably the simplest way to think of institutional arbitrage is to think of a process of deliberately doing something that institutional investors are unlikely to do. This is accomplished in a number of ways including – 1) maintaining a longer term horizon, 2) emotion control, 3) equity research process discipline, 4) proprietary insights, 5) maintaining a concentrated portfolio (i.e. anti-indexing), and 6) maintaining appropriate levels of cash in the portfolio. See the chart for an illustration.

The core idea here is to do something that you know the majority of market participants are not doing. Obviously if you did the same things that every other investor does, you wouldn’t expect to outperform those investors. As basic as this might sound, I have learnt that the concept is effectively lost on institutional investors – not because they don’t understand or agree with it, but because financial industry structure does not let them change their behavior. How painful.

To illustrate how this works, take ETFs (or Robo Advisors) for example. If your core value proposition is your technical ability to track a market index as closely as possible while charging a fee, however small, the best you are destined to deliver by definition is underperformance relative to that index you are tracking – underperformance by the amount of fees you are charging. This means as more people gravitate toward indexing (just because they might have had enough with mutual funds or “private wealth managers” already), the institutional system becomes even more vulnerable to arbitrage by independent active managers.

The ETF argument can be easily extended to the vast majority of mutual funds who charge higher fees but deliver nothing more than underperformance, with portfolios that “closet index” under the pretext of diversification. Of course all of this looks much worse when applied to hedge funds charging even higher fees, but conveniently forgetting to do the work (equity research) needed to select investments.

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosures and Disclaimer