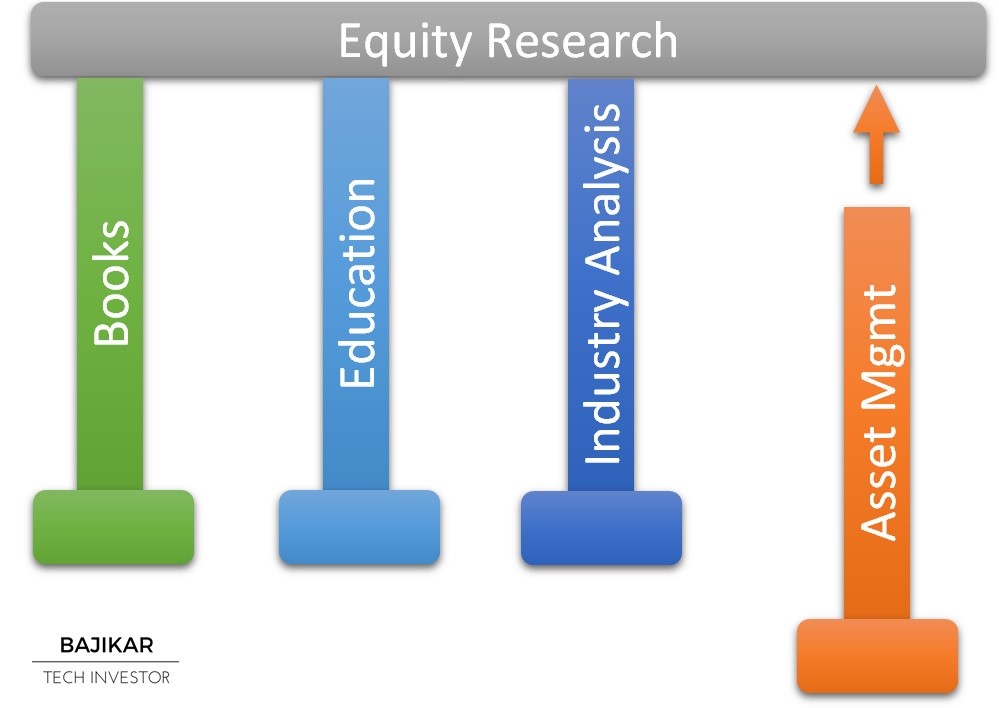

In the last chapter of my book I introduced aspirational ideas for asset management. Here I build on those ideas to sketch a conceptual equity research platform, with a set of mutually reinforcing capabilities, services, or products to be built progressively over time.

Given the breadth of activities involved in investment management, from pondering behavioral issues to generating views on the market, as well as analyzing specific industry/company topics within the Technology space, there is essentially an inexhaustible amount of information and insights that can be communicated to existing and prospective clients – but usually isn’t. Books might serve as a good medium to capture relatively static aspects of the investment strategy or process, while a blog would provide means to stay engaged with clients. Hopefully the combination provides more transparency, education and client service satisfaction than a powerpoint pitch for assets, followed by quarterly reports of performance.

I have found that teaching others is a highly effective way to identify and close gaps in my own understanding of various things. Teaching or coaching candidates from a variety of different backgrounds would be even more effective, because it would uncover new frameworks, corner cases, or opportunities for improvement or simplification. Yet this does not seem to be common practice within the asset management industry.

Industry analyses, perhaps in part in the form of consulting projects within the Technology industry, would surely generate what I have previously referred to as proprietary insights, which if used effectively, would serve as a basis for investment outperformance.

Beyond providing education and generating insights, each of the above activities would also serve to extend the reach of the platform from a marketing standpoint, in a way that is both more meaningful and less transactional.