INFN stock is down ~50% YTD driven by sharp YoY declines in revenues and earnings (see chart below). Both company management and investors seem to

Category: 4SAFEt

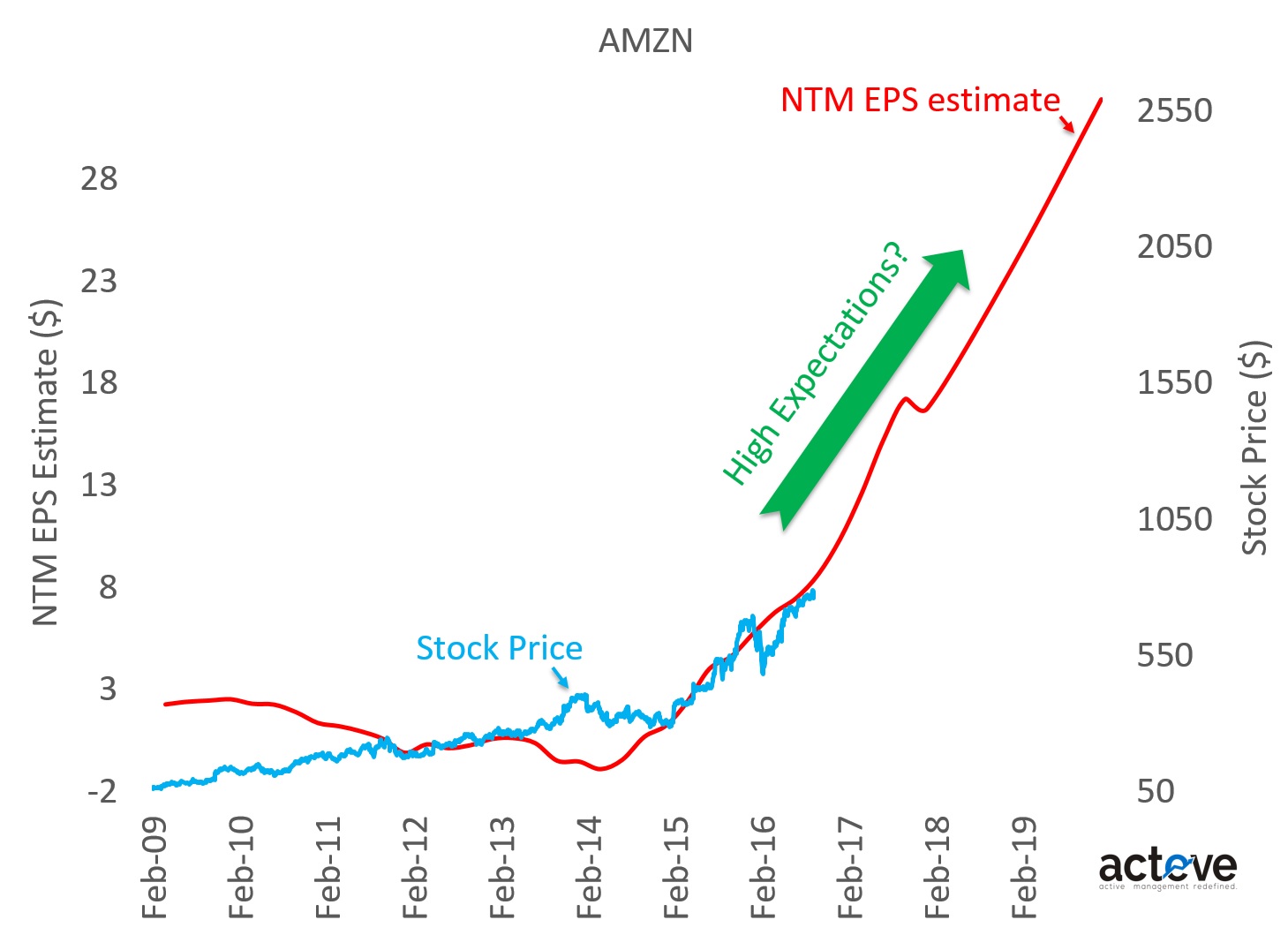

I previously wrote about AMZN valuation risk here, and valuation will often be a concern for high-growth companies. Implicit in that view is a concern

$CAVM traded down ~5% the day after the company reported a 3Q16 beat both on earnings and 4Q16 guidance. The chart below suggests short interest

I am excited to announce a new Black & White Paperback Edition of my book has been published on Amazon.com and is available for purchase

Click on the image below to see my interview on Beyond Quant’s website: Disclosures and Disclaimer

Both AMD and NVDA offer exposure to GPU Compute, arguably a very desirable capability with growing applications in artificial intelligence, AR/VR and self-driving car. Both

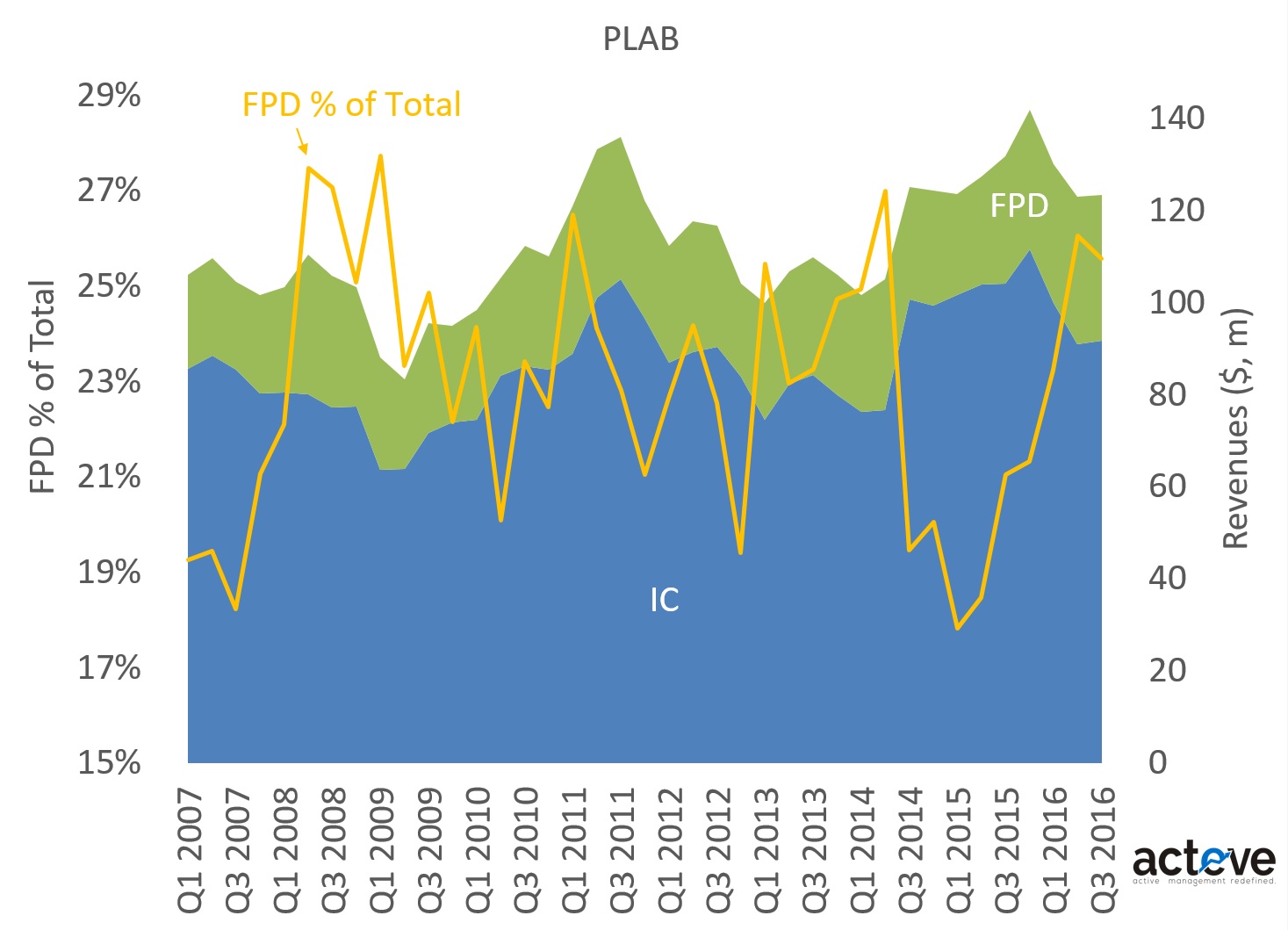

Photronics (PLAB) makes photo masks for semiconductor and display panel manufacturing. The chart below shows PLAB’s revenue mix. Over the last 6 quarters, flat-panel display

The chart below suggests that INVN stock price is tracking below NTM EPS projections, an understandable dynamic following severe dislocation in Invensense’s gyro/OIS market share,

Let’s assume that sellside estimates are representative of investor expectations for $AMZN (as discussed in my book, that is not always the case). The NTM