I am codifying a 7-step process that I have mentally followed for the last fifteen years to help me think in a structured fashion to

Category: 4SAFEt

Asset Allocation has been shown to be the dominant (90%+) driver of portfolio returns, with stock selection playing a smaller role. Asset Allocation represents a

Stock Prices can be linked to business fundamentals through one or more Valuation Metrics. When a given valuation metric is found to track (i.e. correlate

SYNA stock is down ~25% YTD, trading at EV/S of ~1x (vs. peer group at ~3x+), a valuation discount worth exploring. Synaptics was affected by

FCAU (Fiat Chrysler Automobiles) appears to be attracting attention recently, with the stock up ~27% over the last 3 months vs. S&P 500 index up

Earlier this week Micron increased its earnings guidance for the quarter ending Nov-16, to be reported later this month. Revised guidance is for revenues and

You and I use the word “risk” frequently in our lives, without really thinking about its definition or knowing whether others around us think of

Many thanks to Jake Taylor at 5GQ for creating this interview with me. Jake certainly does ask 5 Good Questions. Hope you enjoy it.

Many of you have asked for my book recommendations, so I decided to publish book reviews after first introducing a reading list for value investors.

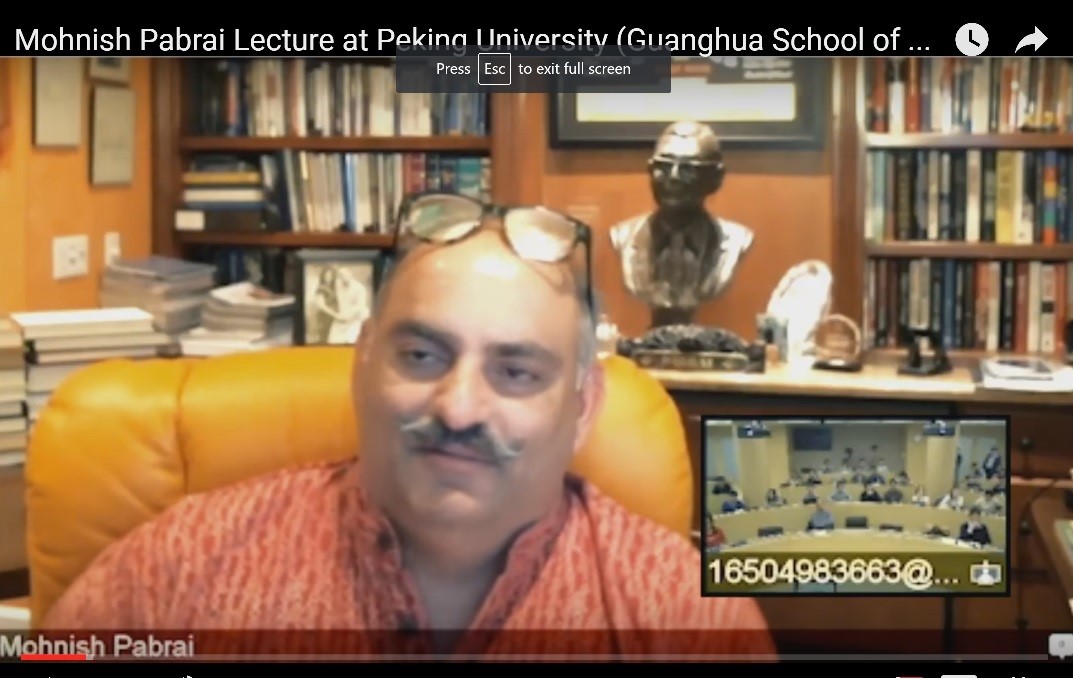

Here are some of my takeaways from this wonderful talk given by superinvestor (value investor) Mohnish Pabrai last month (October 2016) to a classroom