I previously wrote about AMZN valuation risk here, and valuation will often be a concern for high-growth companies. Implicit in that view is a concern that revenue growth might decelerate (too soon). What if 1) the target market is measured in trillions of dollars, 2) disruptive business model is working across multiple verticals, 3) earnings are continuously plowed back in as investments to drive growth, with an ultra-long-term time horizon, and 4) growing scale is already translating to gross margin expansion? If those things weren’t enough, what if the stock also trades at a discount to its peer group, likely because 1) investors inherently have a short-term horizon, and 2) investors implicitly do not believe the company will (ever) allow gross profits to fall to the bottom line.

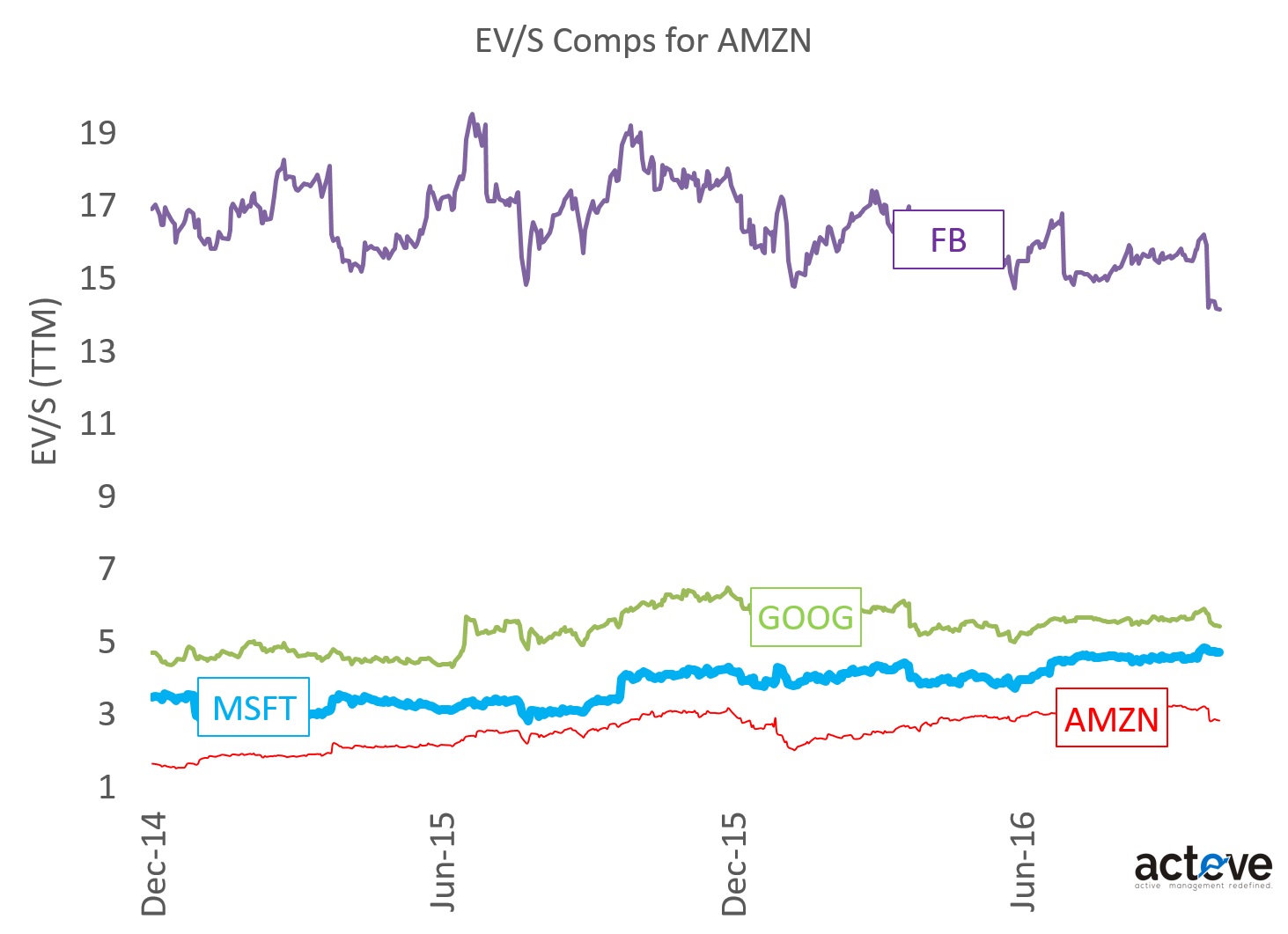

Let’s start with the valuation discount. The chart below shows that AMZN trades at EV/S of ~3x, at the low end of the range for its peer group comprised of FB (15x), GOOG (5x) and MSFT (4x).

The trick here is to use EV/S rather than P/E, because if you read CEO Jeff Bezos’ shareholder letters, it is abundantly clear that he is not (never was) interested in serving the shorter-term interests of shareholders, in favor of building great value for the longer term – in other words, his focus is likely not on maximizing (shorter-term) EPS.

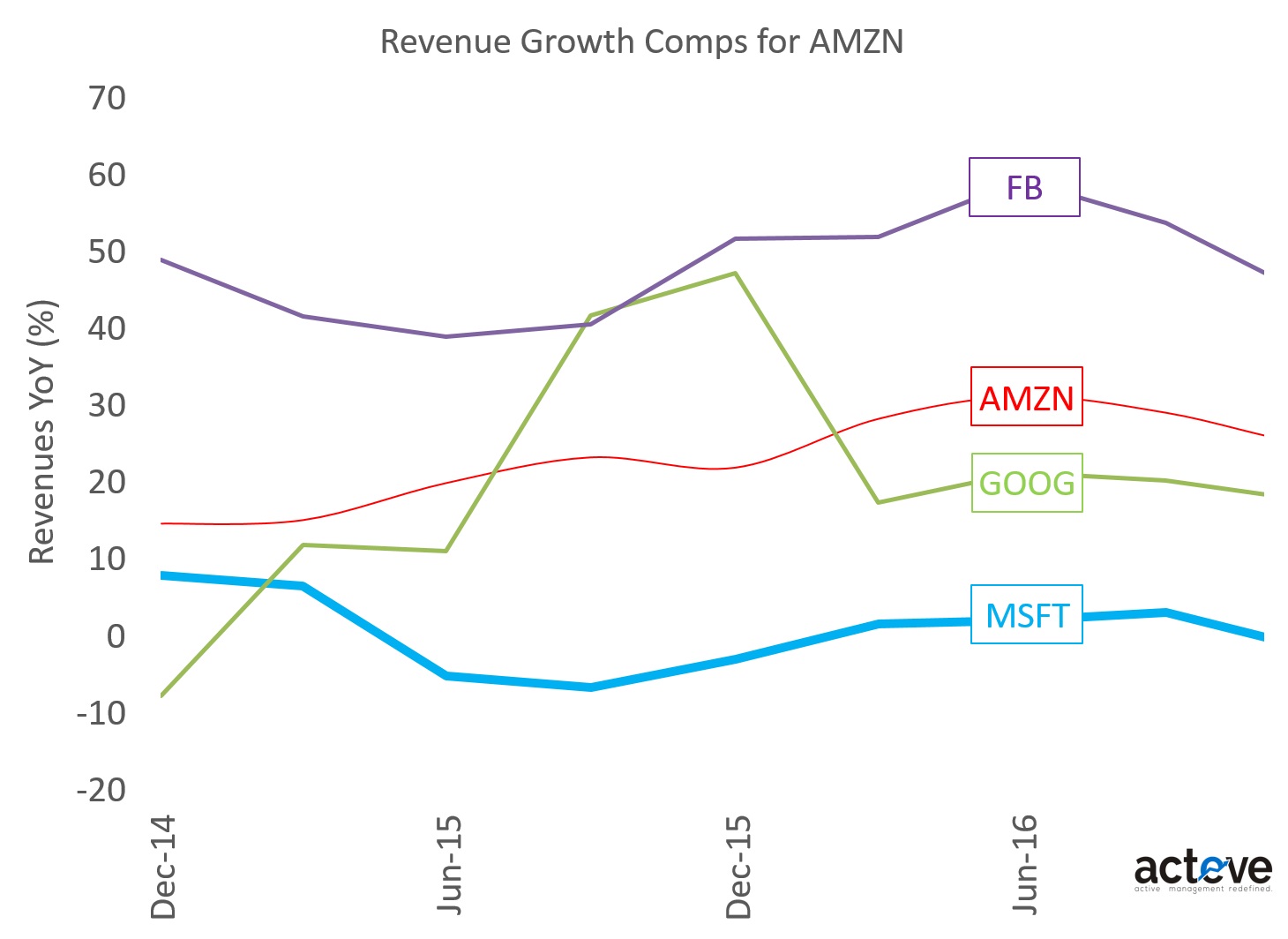

Comparing revenue growth rates across the group (chart below) suggests AMZN’s YoY revenue growth is second after FB’s, higher than GOOG or MSFT’s. So a lower growth rate doesn’t explain the valuation discount.

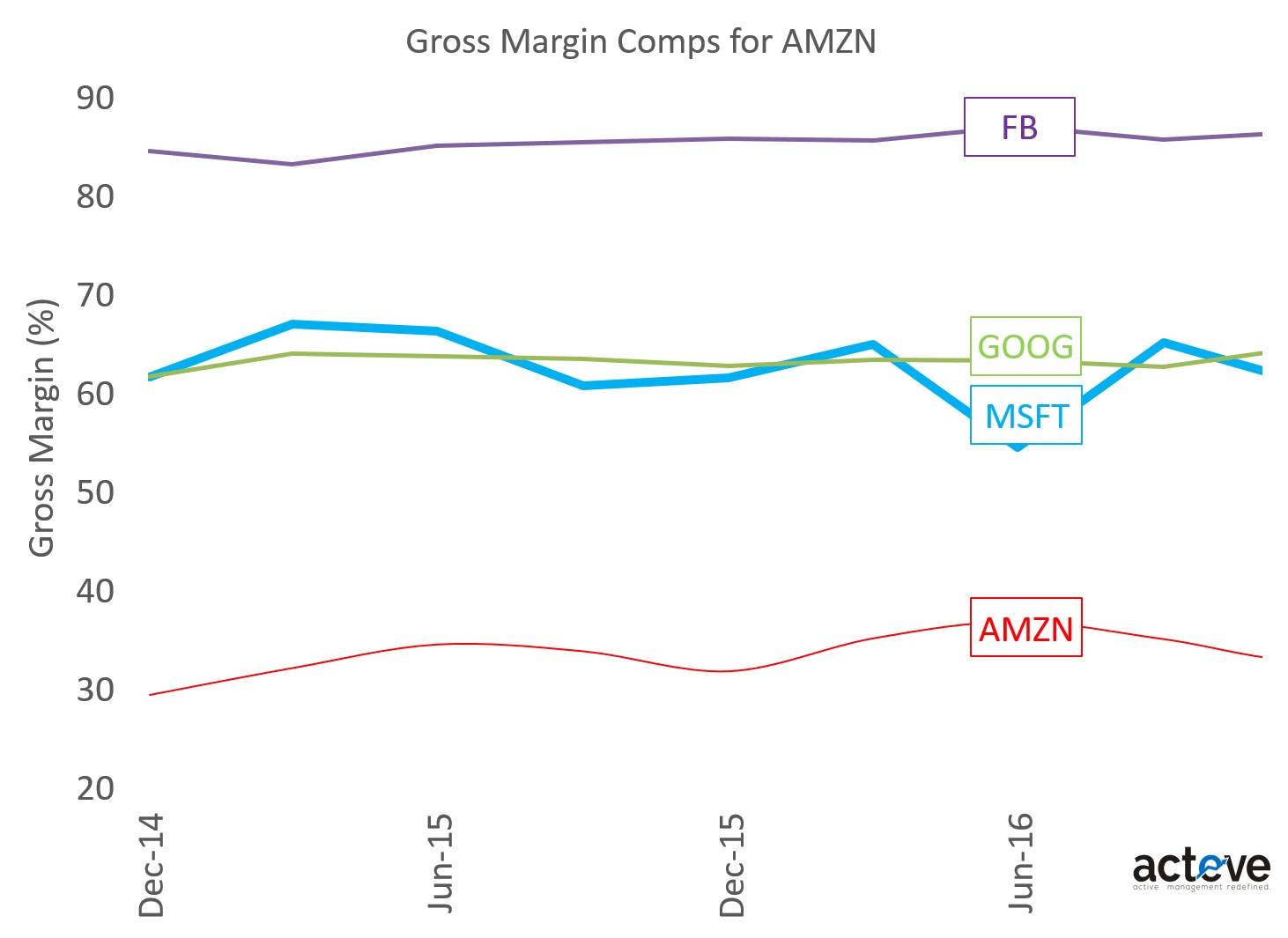

Looking at gross margins (chart below) gives us a clue. AMZN sports the lowest gross margins of the group, at ~35%. This is a far cry from FB’s 85%, or GOOG/MSFT’s ~60%. Looking further below the line gets more disappointing, as ongoing investments leave only a small net income if any for shareholders to value.

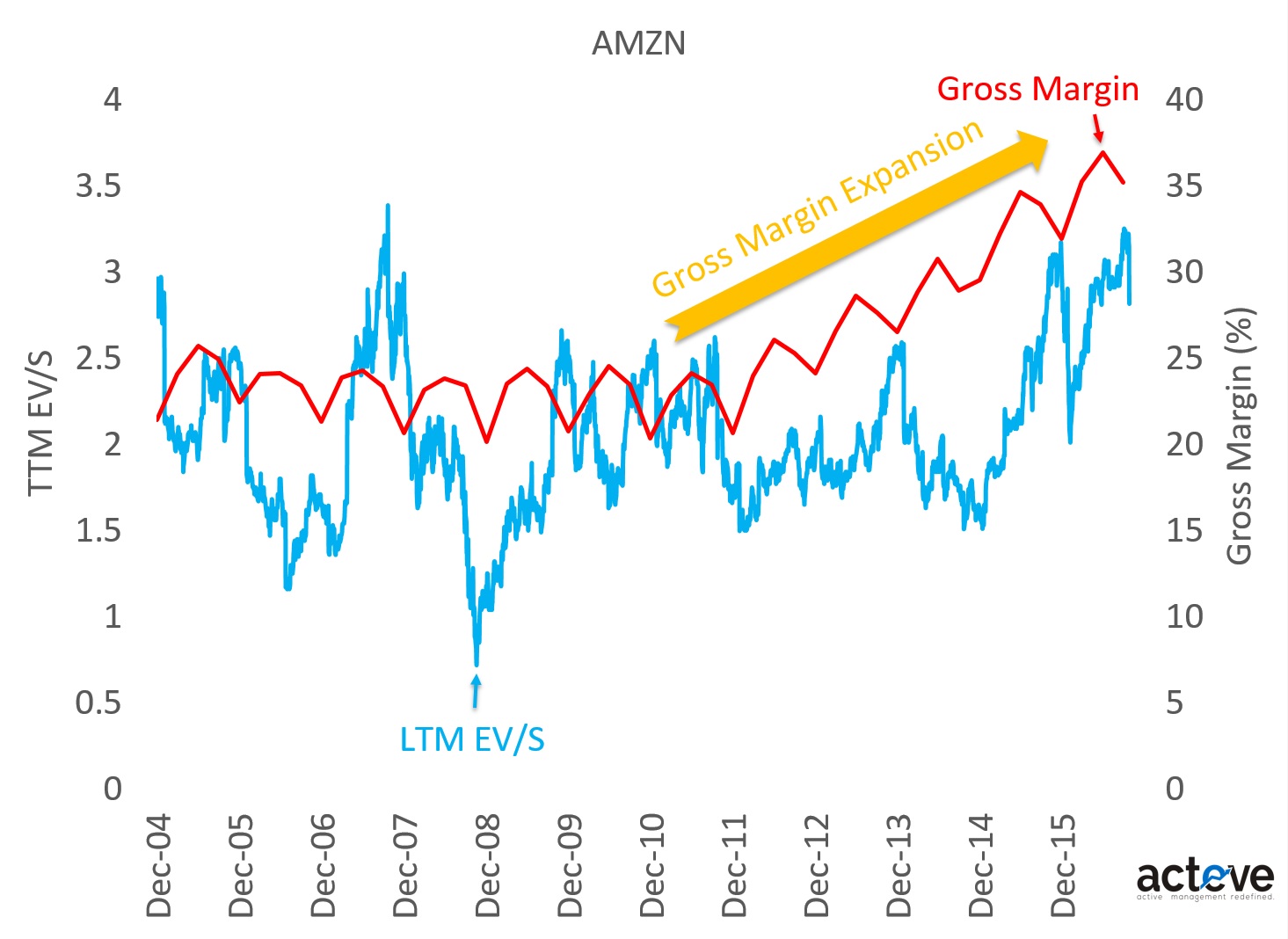

Even though AMZN gross margins might be lowest in class, they have expanded by >1,000 bps over the last few years (chart below), one sign that greater revenue scale is translating into improved profitability.

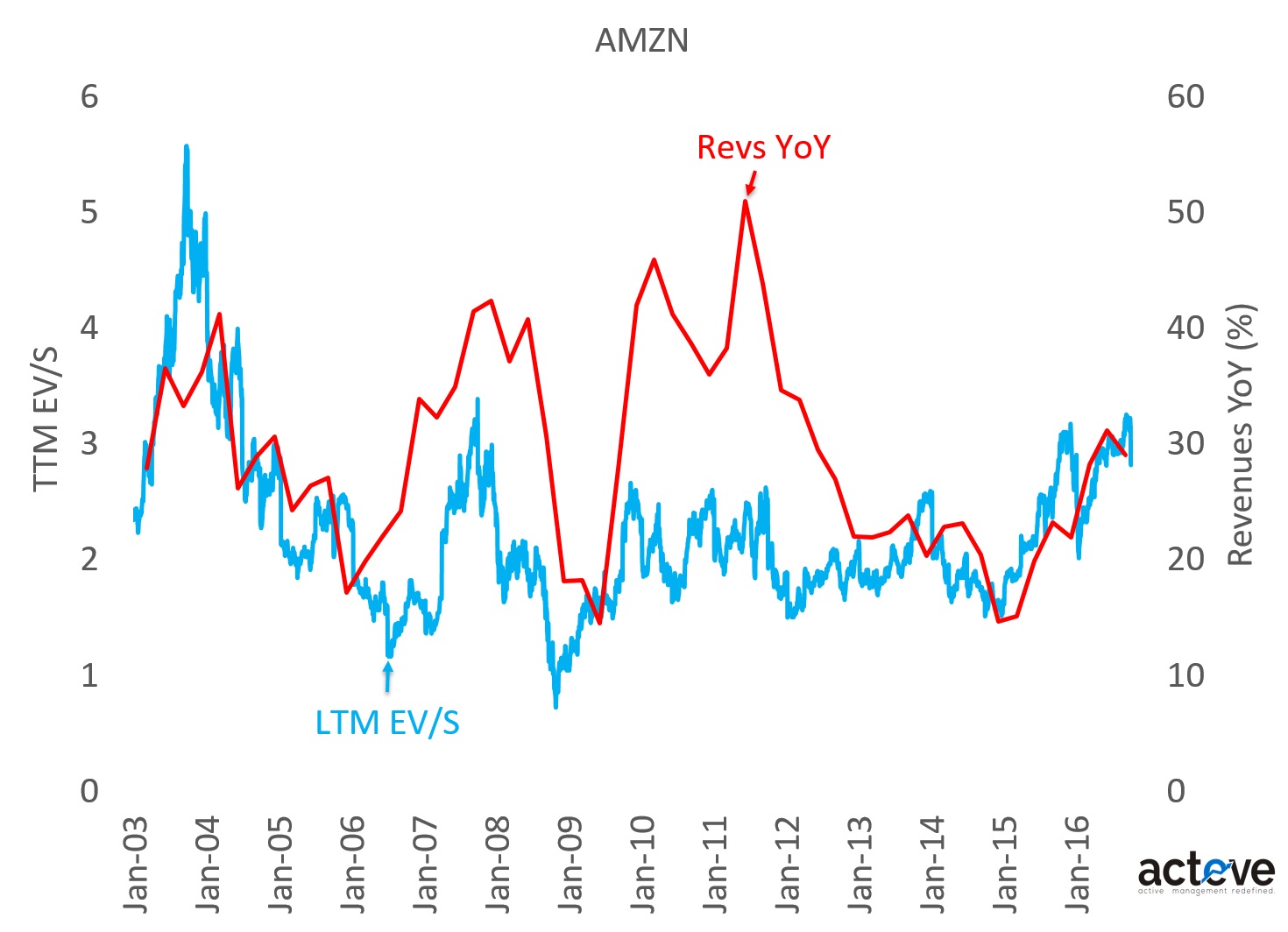

Over time it is possible that when revenues can no longer grow at double digits, that valuation is driven to a greater extent by higher gross margins rather than YoY revenue growth like it seems to be now (chart below).

Reading the AMZN CEO’s shareholder letters, it seems like the “end game” for the stock might be comprised of slower revenue growth together with dramatically higher gross margins as well as valuation. With a multi-trillion dollar addressable market, it is less clear when we might get to such an end game. While this might bother many an investor, it does seem to have the makings of a long-term compounding value stock.

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosure: As of this writing the acteve Model Portfolio (aMP) held long positions in GOOG and AMZN stocks, but no positions in FB or MSFT.

Additional Disclosures and Disclaimer

Stock market data provided by Sentieo.