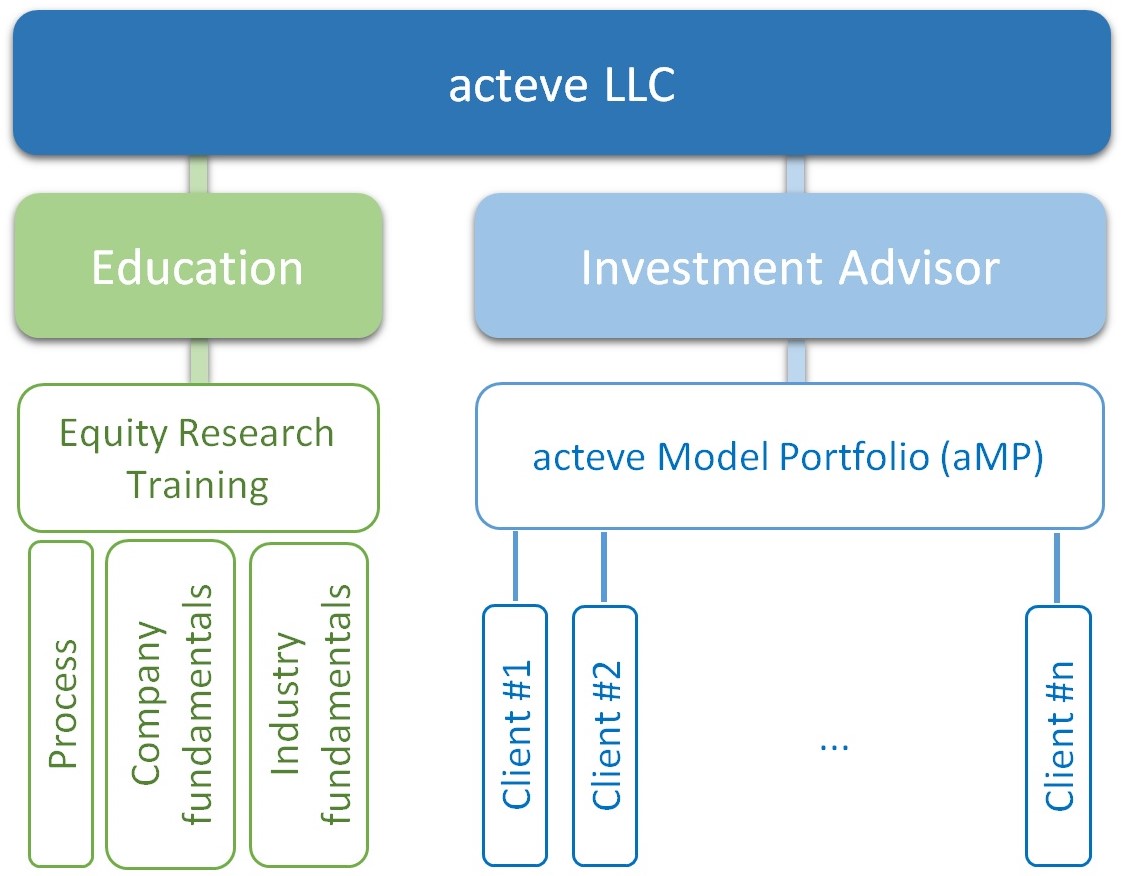

acteve LLC is an investment advisory firm based on ideas I have previously discussed here, as well as in my book. Unlike the “pooled assets” model commonly used by mutual funds and hedge funds, I believe advisory services provided for client-managed accounts can enable a superior alternative for the purpose of providing maximum transparency to clients. The chart below illustrates the topology of acteve’s investment management framework.

Lets start by defining transparency first: as an investment advisor client, you want to know 1) what stocks (or other securities) you own in your portfolio, 2) why you own each of those stocks, and 3) how your portfolio is advised to deal with various (unpredictable or predictable) market events. Such knowledge should serve as the foundation and basis of (continued) trust in your relationship with your investment advisor. Yet this type of information is not readily available in the case of most institutionally managed portfolios – i.e. mutual funds or hedge funds.

Within my framework, there are two distinct but related elements – 1) Education and 2) Investment Advisor. The Education element is designed to deliver transparency by providing information about a) stock selection process (i.e. equity research process), b) fundamental research on individual stocks, and c) industry research on a broad range of topics.

While the Education element may or may not be executed under the purview of a fiduciary relationship, the Investment Advisor element most certainly would be. In other words, clients engaging only to learn how to become better investors themselves, would still be fully responsible for their own investment decisions, as no fiduciary relationship would have been created. Whereas clients engaging in an investment advisor relationship would benefit from specific investment advice based on the acteve Model Portfolio, as well as ongoing education, with the investment advisor obligated to always act in the best interests of the client (the fiduciary part of the relationship).

Why bother with Education? If all you want is for your portfolio to outperform the market benchmark in every possible period you can think of, then you might find the education element unnecessary. What you might benefit from instead would be a whole lot of pure good luck! Where our counselling effort might help would be in understanding 1) how our process works, and why it works, 2) what you should expect from our advice based on the acteve Model Portfolio, and 3) why even with industry knowledge and investment training, you might still find investing on your own difficult.

acteve’s core strategy is to make the benefits of “institutional grade” active management accessible and more transparent to individual investors (including family offices, trusts, other investment advisors, etc.), because we believe such an offering would probably be attractive to a broad range of well-qualified clients. We think our approach would be especially interesting to professionals who not only care about superior long-term portfolio performance, but also want to understand and perhaps participate in the process together with us.

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosures and Disclaimer