SYNA stock is down ~25% YTD, trading at EV/S of ~1x (vs. peer group at ~3x+), a valuation discount worth exploring. Synaptics was affected by the Samsung Galaxy Note 7 fiasco over the last year, as well as a secular shift toward integrated touch+display-driver (TDDI), starting with lower-margin low-end phones in China. The shift toward TDDI is actually one Synaptics itself is leading.

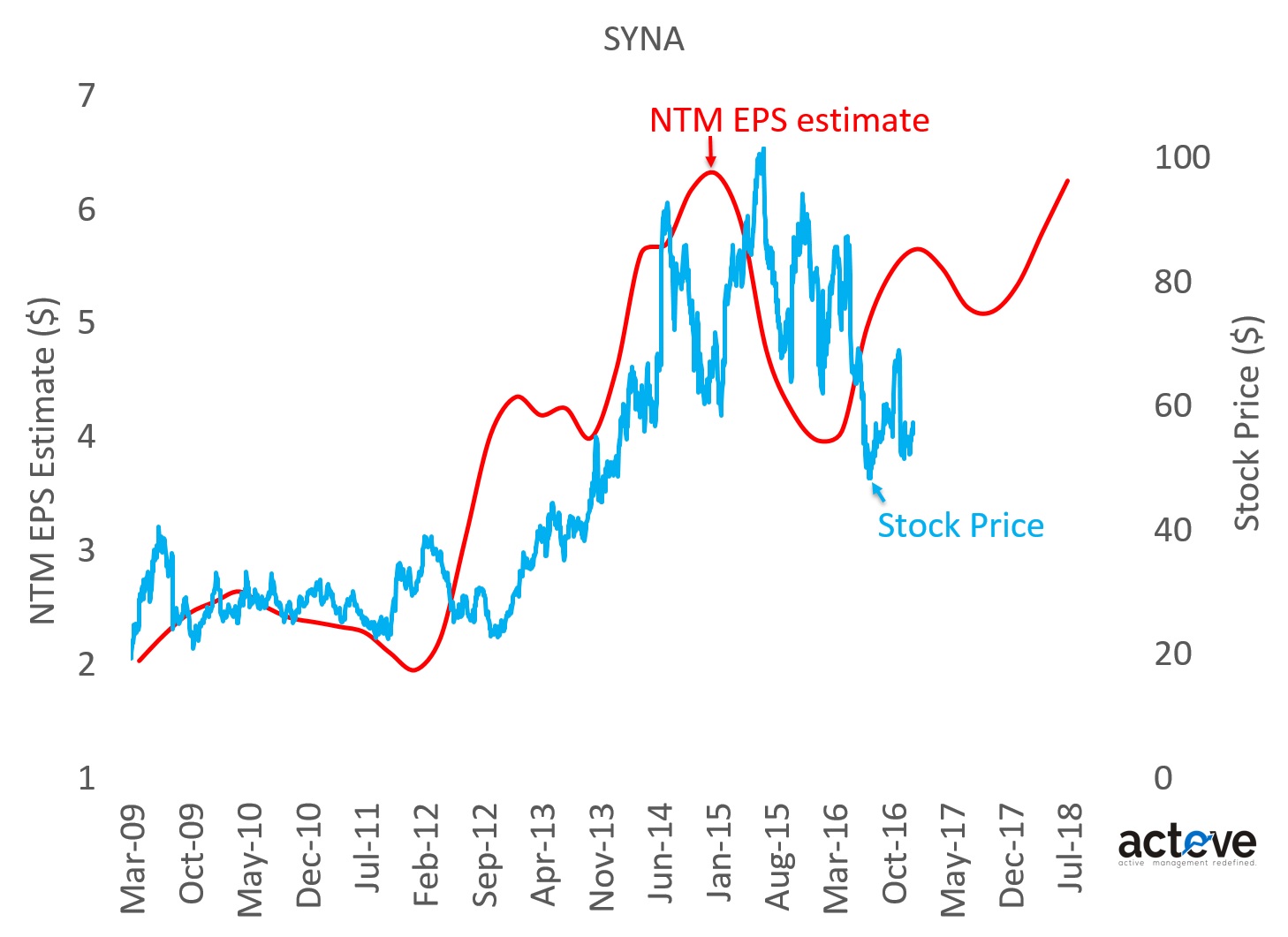

The chart below shows SYNA stock is tracking below NTM EPS estimates, driven by multiple compression.

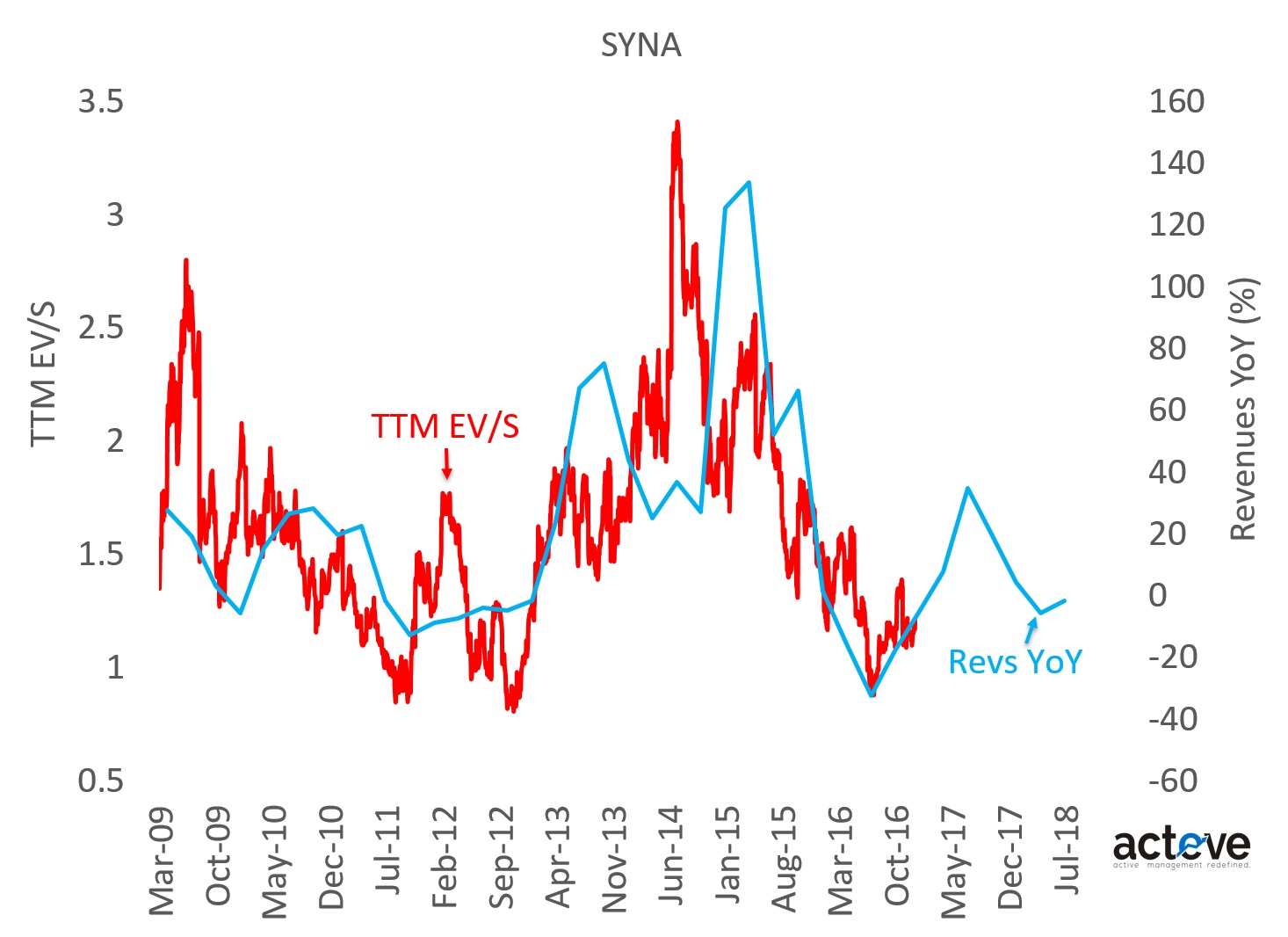

The chart below suggests LTM EV/S compression was driven in part by deceleration in YoY revenues. The sellside appears to be modeling an imminent inflection in YoY revenues.

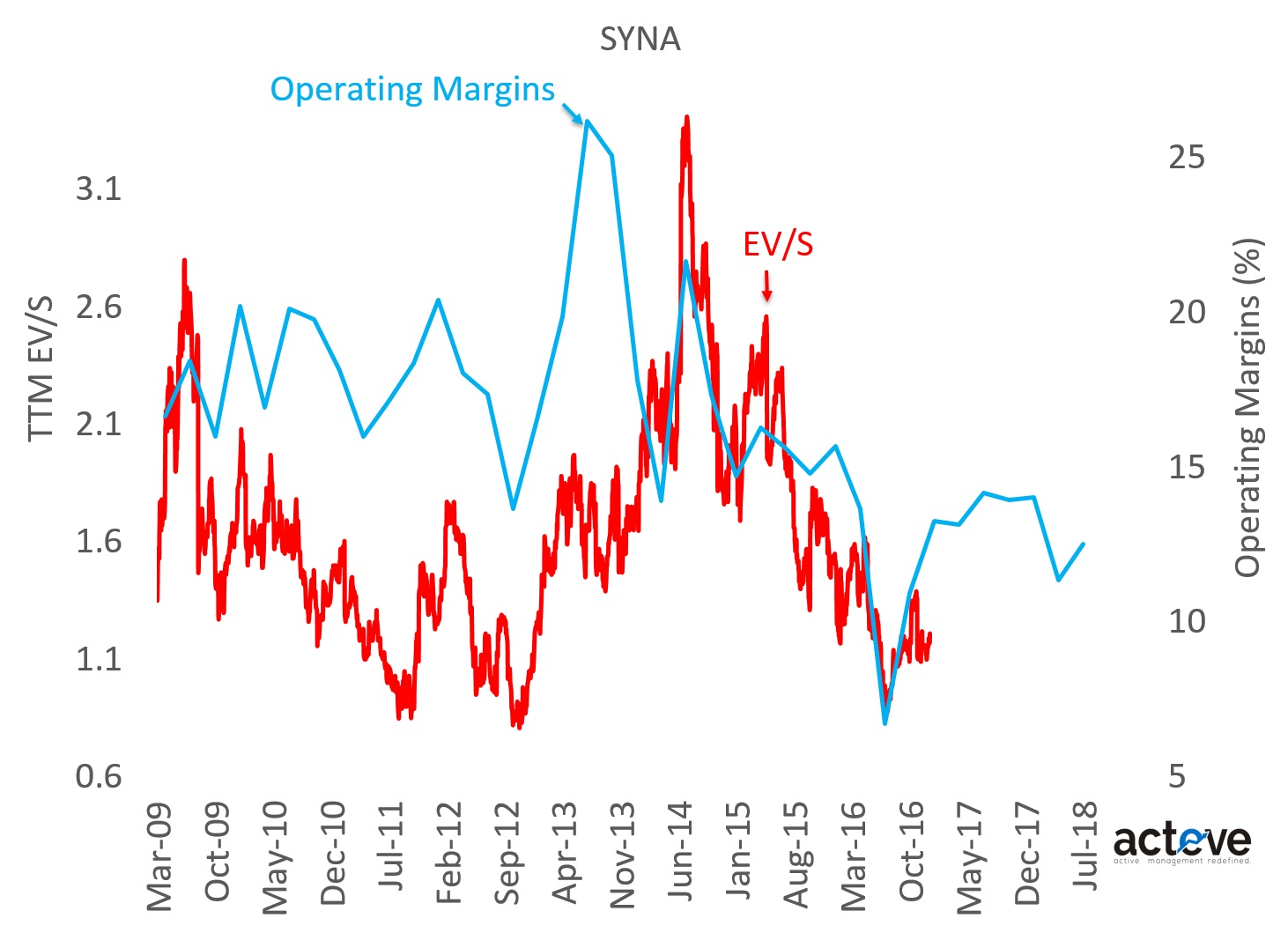

The chart below suggests Operating Margin compression is also responsible in part for multiple compression.

Accordingly, it would probably be fair to expect a recovery in valuation to be driven by:

1. Inflection in YoY Revenue growth

2. Operating Margin expansion

Operating Margin expansion in turn could be driven by one or more of the elements below:

1. Continued ramp of TDDI

2. Display driver and/or TDDI ramp for OLED

3. Growth in Fingerprint sensor

4. Growth in PC

With technology leadership, a strong market share position, a robust balance sheet, and strategy to grow into new markets including AR/VR and self-driving car, it is difficult to believe that the company would not be able to achieve its short-term, medium-term or long term model targets recently provided at its analyst day on 12/13/16.

Author: Sundeep Bajikar

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosure: As of this writing the acteve Model Portfolio (aMP) held a long position in SYNA.

Additional Disclosures and Disclaimer

Stock market data provided by Sentieo.