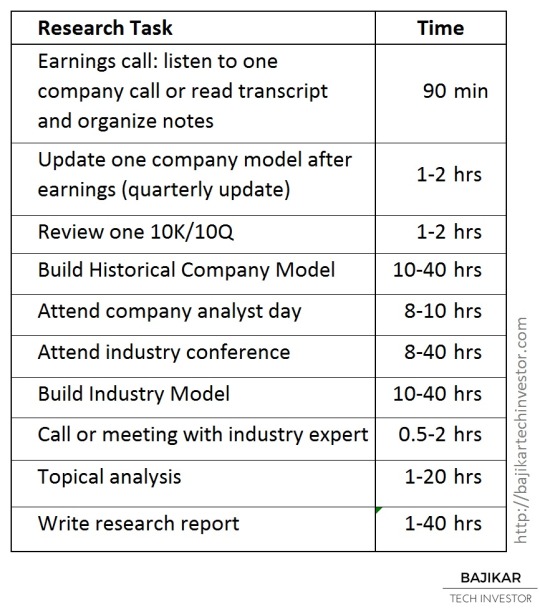

The table below should give you some idea of the time it takes to execute different research activities required to analyze a given company.

Depending on the size of the company, the complexity of its operational history, competitive and supply chain dynamics within the industry, and ease of access to information, it could take more or less time than that indicated by the ranges in the table. Assuming good access to information (even if for a fee), building quantitative models is probably the easiest part of the research effort, only requiring relatively basic knowledge of accounting, and process discipline to make sure that excel-based model work is error-free. Industry analysis on the other hand is much harder, and activities related to conference attendances, and interviewing industry experts may need to be repeated multiple times to form a high-confidence qualitative view of the industry.

Disclosures and Disclaimer