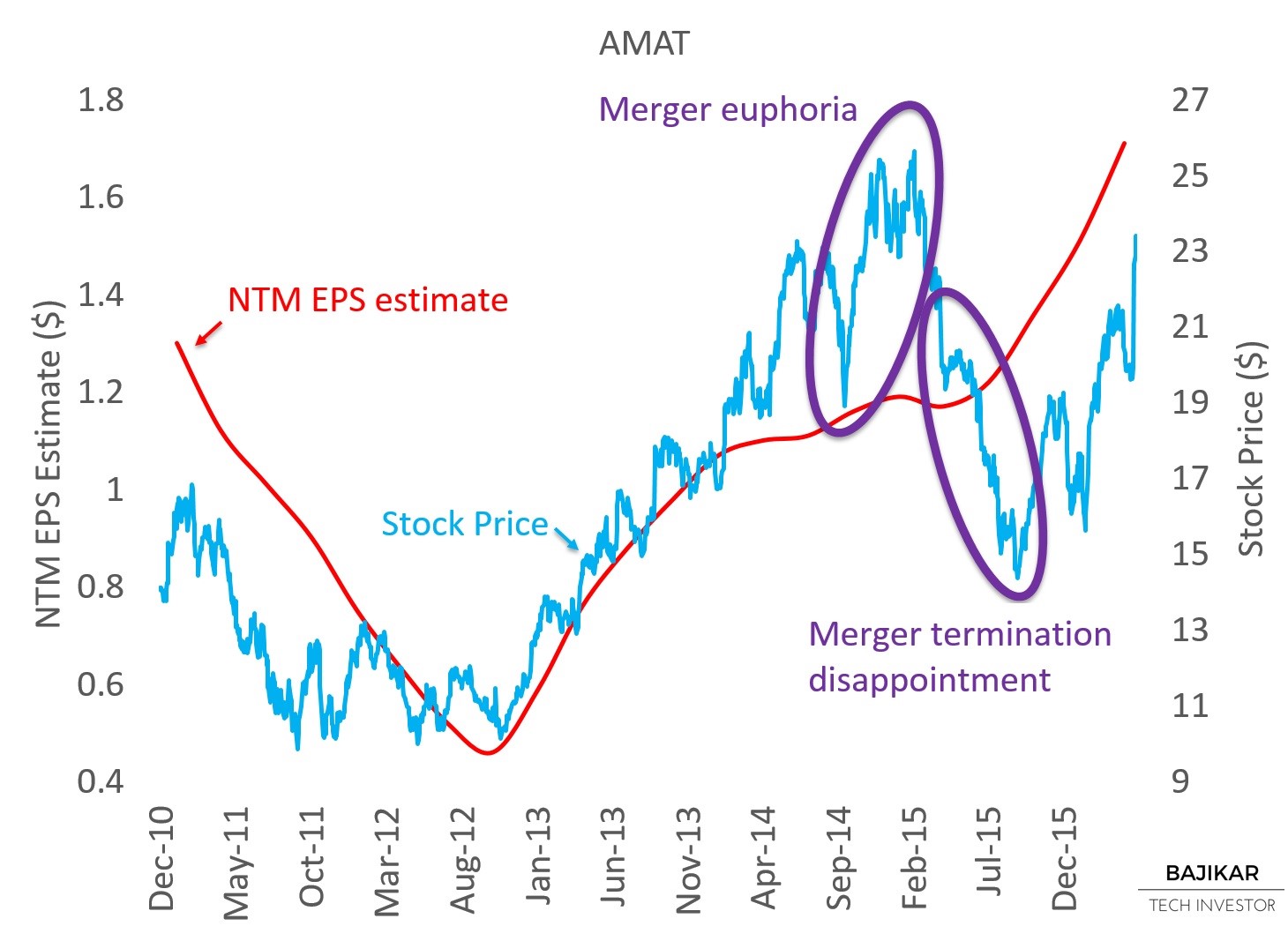

Picking up where I left off discussion of AMAT in my book, the period following TEL (Tokyo Electron) merger termination proved to be a good time to buy the stock, with good margin of safety. As the charts below illustrate, even though fundamentals for AMAT (as represented by NTM EPS estimates) on a standalone basis remained generally stable with an upward bias over the last couple of years, AMAT stock took big swings up and down around announcement and termination of AMAT’s merger with TEL. This should have allowed a value investor to make a relatively quick, safe, and significant return on the stock, as it is now playing catch-up with generally positive fundamentals.

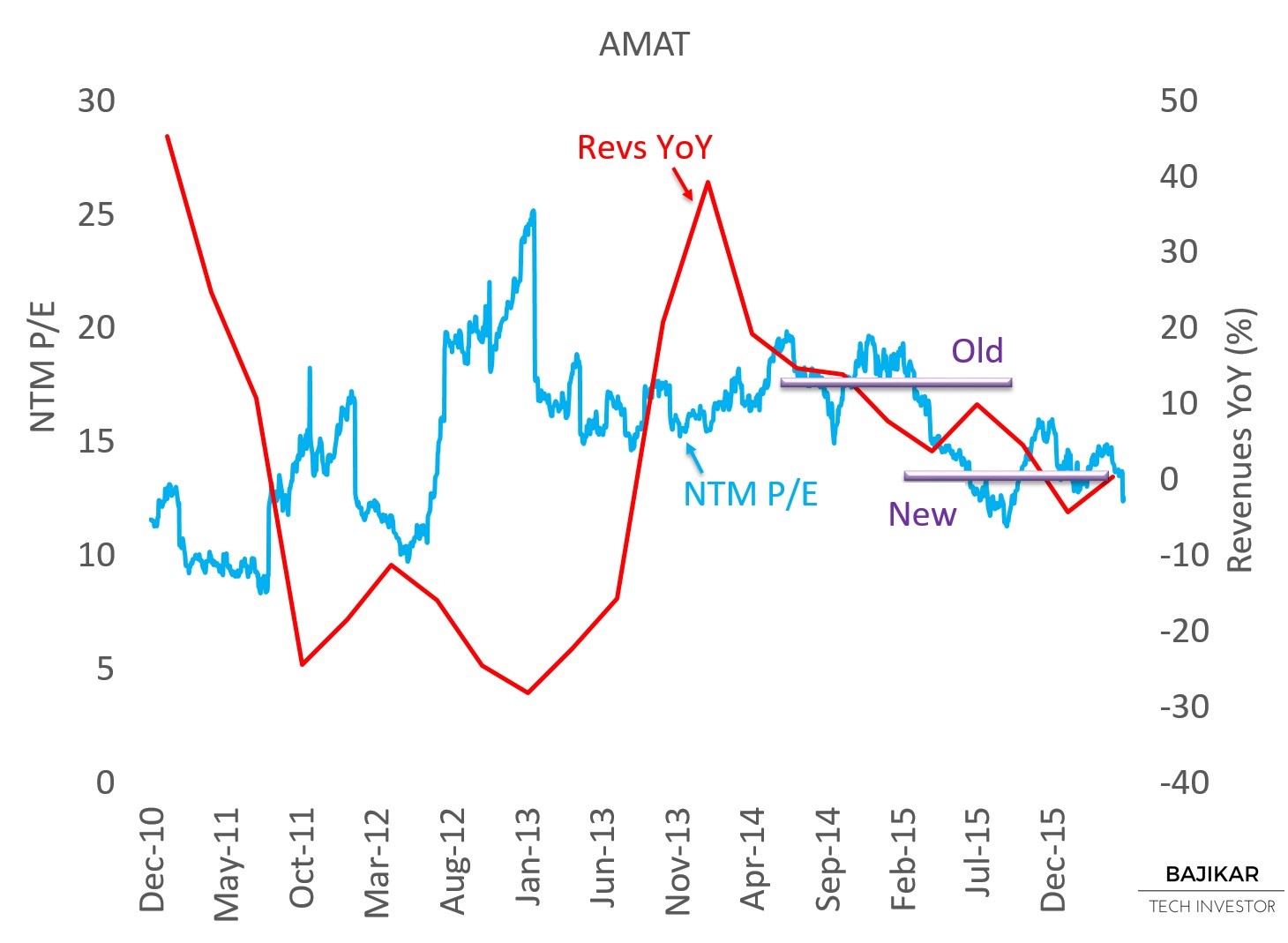

The chart below shows that AMAT’s NTM P/E compressed following merger termination, to below pre-merger-announcement levels, implying investors were skeptical of the company’s solid standalone fundamentals driven by 3D NAND, leading-edge foundry/logic, and OLED display related equipment.

After rising approximately 14% in the trading session following its earnings call on 5/19, AMAT stock now appears to be on its way catching up to underlying fundamentals. In my view AMAT is a good example of how value investors can make sizable investment returns in Tech, while underwriting limited idiosyncratic risk, through equity research.

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosure: At the time of writing my book earlier this year, I held long positions in AMAT; but as of this writing the acteve Model Portfolio did not hold any positions in AMAT stock.

Additional Disclosures and Disclaimer

Source: Stock market data provided by Sentieo