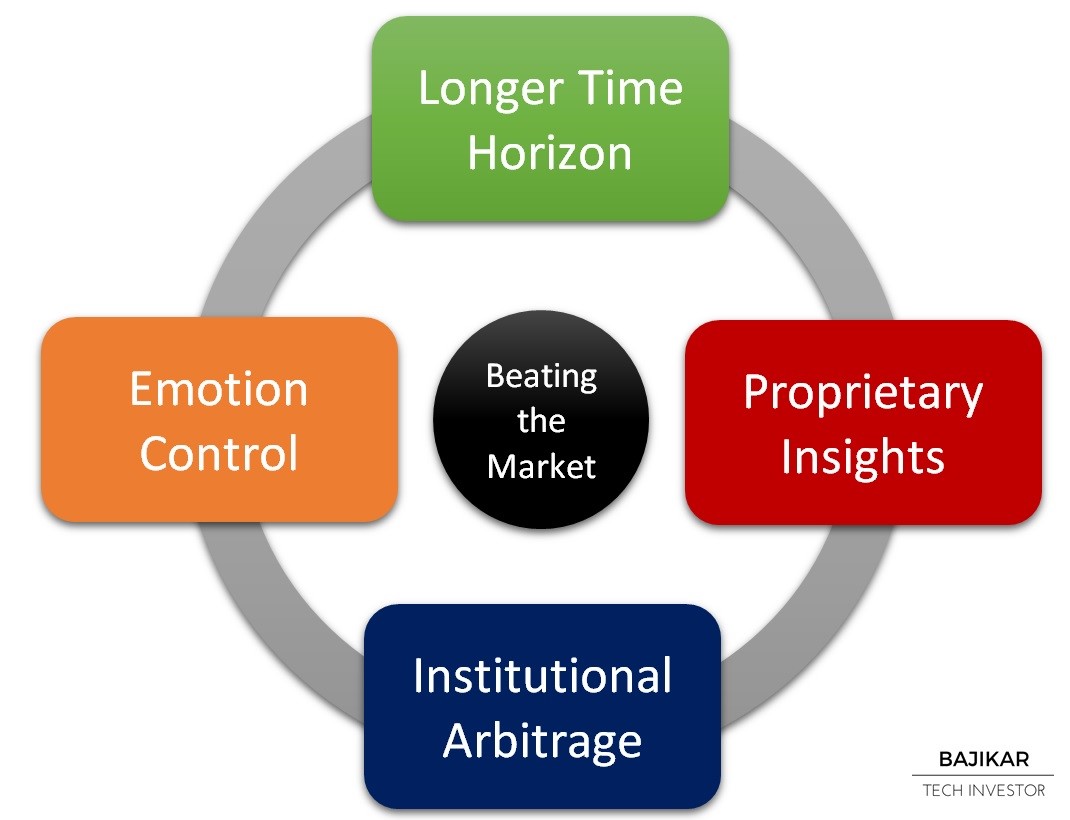

Within acteve’s investing framework there are essentially 4 ways to beat the market. Lets assume for this discussion that you have a genuine need to beat the market, because absent such need you would just be buying/owning the market, probably most effectively through a low-cost ETF. Perhaps the easiest way to think of such a need might be that if the market (e.g. S&P 500 index) is down 40%, then you want your portfolio to not be down as much, or not down at all, if you can manage that. As you might guess, beating the market necessarily means owning something different than the market, in a way that does not mimic how market participants commonly behave. The chart shows 4 strategies to beat the market, 3 of which are in fact behavioral. The strategies are also not mutually exclusive to each other.

Various independent estimates that you can search online for yourself put the average stock holding period at somewhere in the range of a few days to a few weeks, and I wouldn’t be surprised if that period was continuing to decline further as machine trading becomes an even bigger portion of all trading. Jason Zweig of the WSJ wrote an interesting article on this topic last year. An important way to differentiate yourself from the “trading noise” of the market is to take a longer term view of your investments. To be sure taking a longer term perspective does not necessarily mean that you must hold on to your stocks for many years, but rather that you be prepared to do so. There’s nothing wrong (except taxes) with bagging your profits over a shorter period if the stock achieves your price target.

Emotion control is intertwined somewhat with having a longer term investment horizon. Controlling the effect of emotions does not necessarily mean shutting out emotions completely, but instead falling back on a disciplined equity research process to interpret and disposition those emotions appropriately. Taking advantage of your instincts without succumbing to your emotions is certainly not an easy task for anyone, but it is something that I believe you can get better at with conscious effort and experience.

Institutional Arbitrage draws upon both “longer term horizon” and “emotion control” to effectively take advantage of structural weaknesses inherent in the institutional investing process. For various reasons primarily revolving around untimely asset redemptions by clients, institutional managers tend to avoid holding stocks that are prone to short-term volatility, even if they might otherwise qualify as good longer-term investments, within the value framework for example. Independent investment managers with a decidedly more patient client base, can consciously take advantage of this dynamic, by strategically building positions in stocks that are unlikely to draw interest from institutional managers until after such stocks have set an obvious upward trend.

Proprietary insights refers to your information advantage allowable within the context of regulatory oversight. In other words proprietary insights would not include what is commonly referred to as material non-public information (MNPI) by the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA). Instead, proprietary insights represent your unique ability to understand, extrapolate or otherwise interpret various developments occurring around the industry or company that you are following, in a way that the average investor is not equipped to accomplish primarily due to lack of adequate industry domain knowledge.