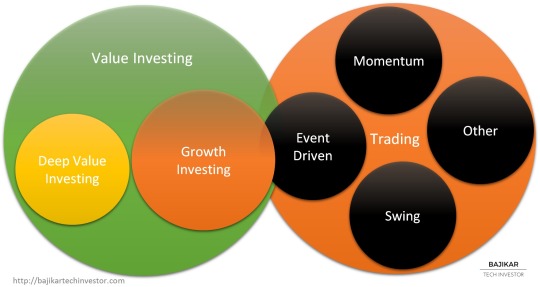

As the chart illustrates, confusing institutional nomenclature notwithstanding, value investing does not exclude growth stocks within my framework.

When Benjamin Graham first introduced value investing, his focus was on estimating liquidation value of assets underlying a stock or a bond, with less importance placed on product or industry-specific dynamics as a source of potential future value. Today, Benjamin Graham’s original approach is sometimes referred to as “deep value” investing. Warren Buffet, Seth Klarman, and other practitioners over time built on Benjamin Graham’s original approach to include a broader range of companies, including what some might call “growth” companies, within the philosophy of value investing. The approach I discuss in my book builds further on Buffet-style investing, with a focus on Technology stocks.