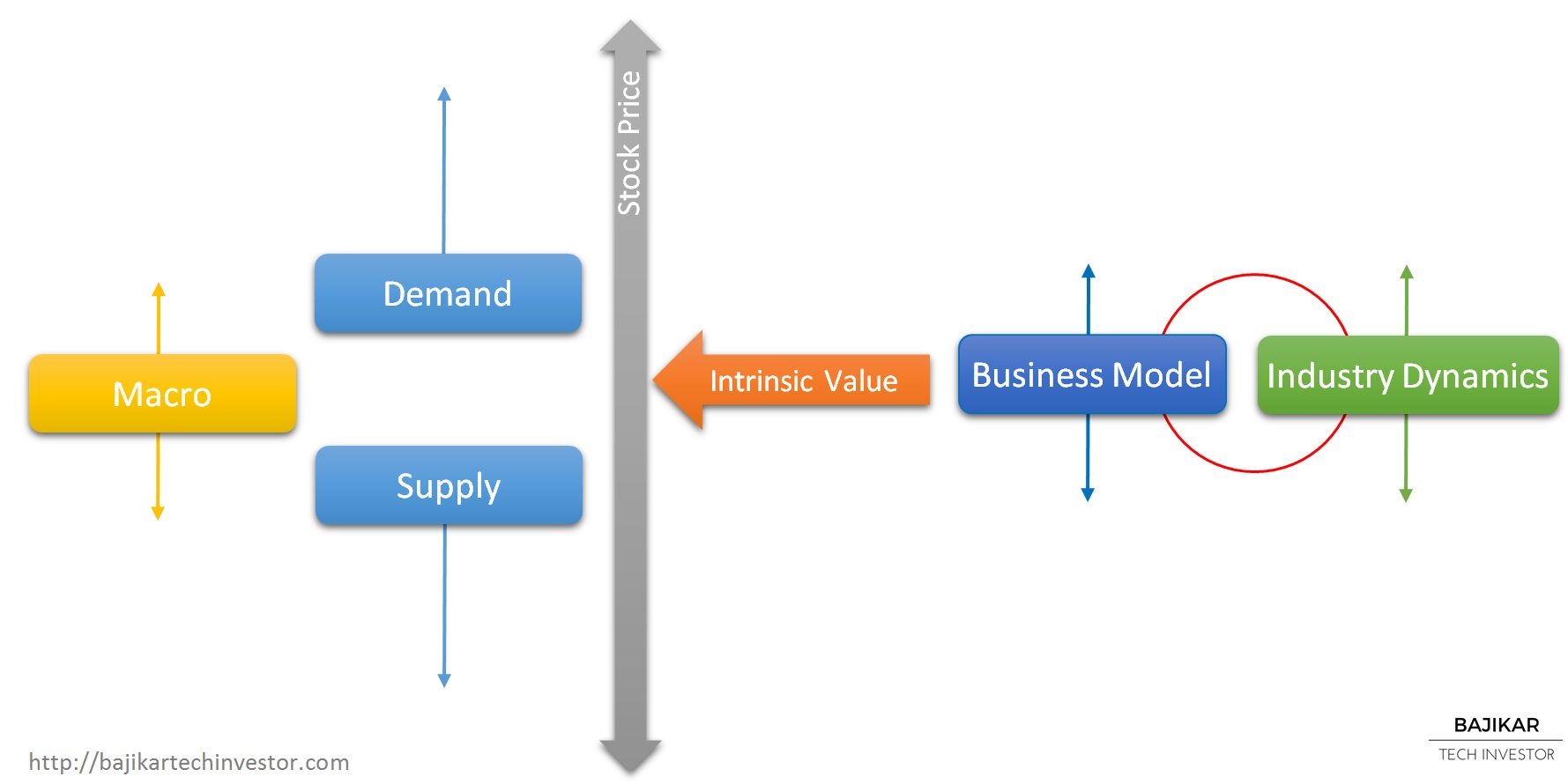

This chart from my book dissects “Company Fundamentals” into “Business Model” and “Industry Dynamics”. While a generalist value investor would be capable of understanding the business model of a technology company, she may not fully understand the influence that various industry dynamics might have on the company’s business model. This affects the process of assessing intrinsic value, and introduces risk in the investment process, making the process difficult to execute successfully.

As I have said throughout my book, if you are investing in technology stocks, but don’t think you have a strong understanding of underlying technology industry dynamics, then I’m afraid you might be misleading yourself or your investors. Furthermore, your chosen investment strategy is then most definitely not “fundamentals-driven”, but rather driven by some other short-term oriented trading strategy that may or may not have a popular name – like “technical trading” or “swing trading” or “momentum trading”.

Disclosures and Disclaimer